Updated November 22, 2023

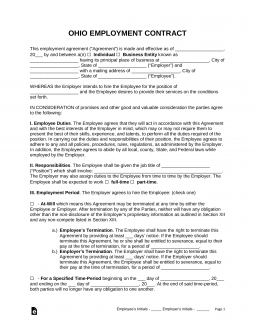

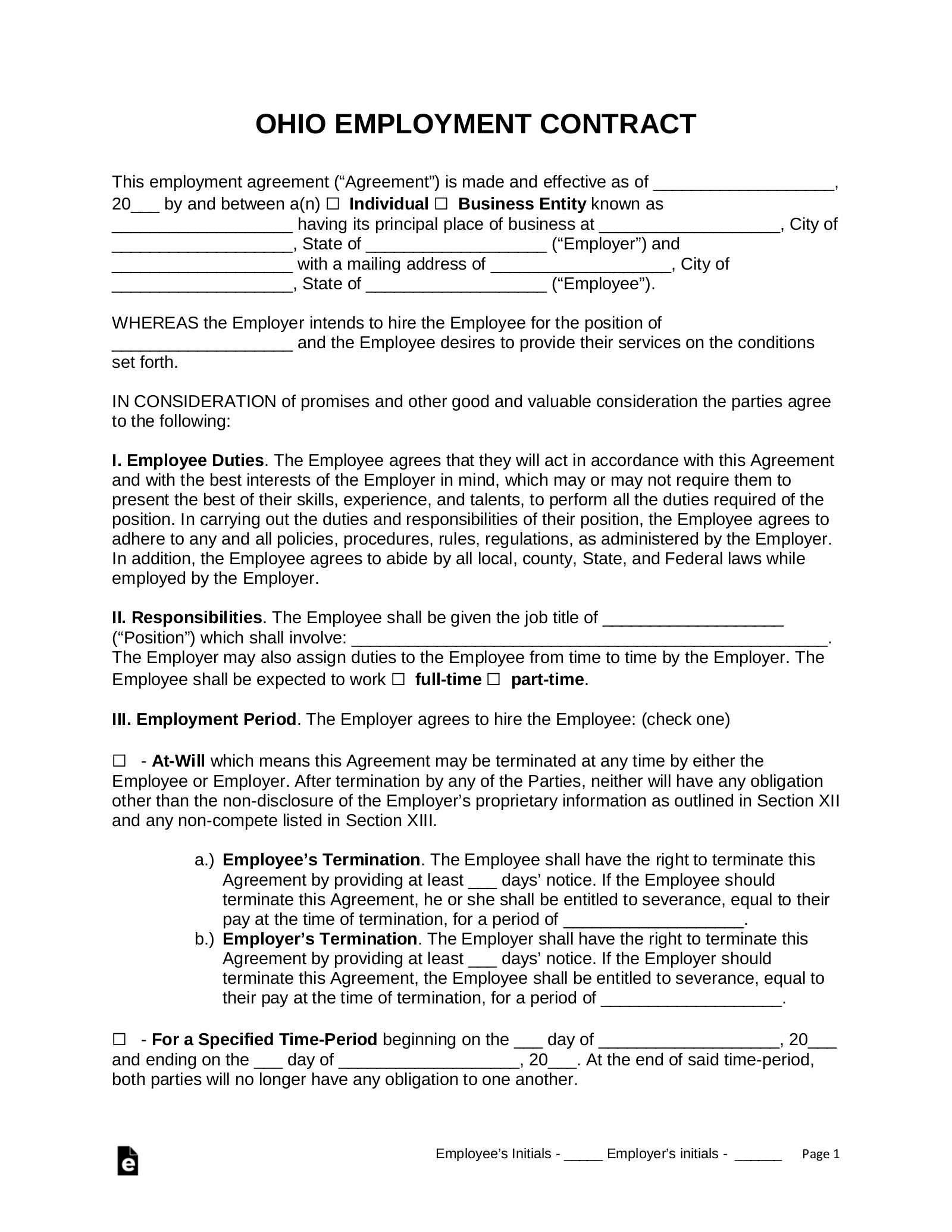

An Ohio employment contract agreement provides an employer with the ability to specify the conditions of employment for a position offered to another party. By drafting an employment contract, the employer is able to solidify the working relationship between them and the individual performing the requested service. Included in the document are articles outlining the individual’s salary, responsibilities, ownership interest, benefits, and other aspects crucial to the employer-employee relationship. Not only does the agreement set forth the employer’s terms, but it also shields them from certain liabilities should the employee violate the contract or initiate a legal claim against them.

By Type (4)

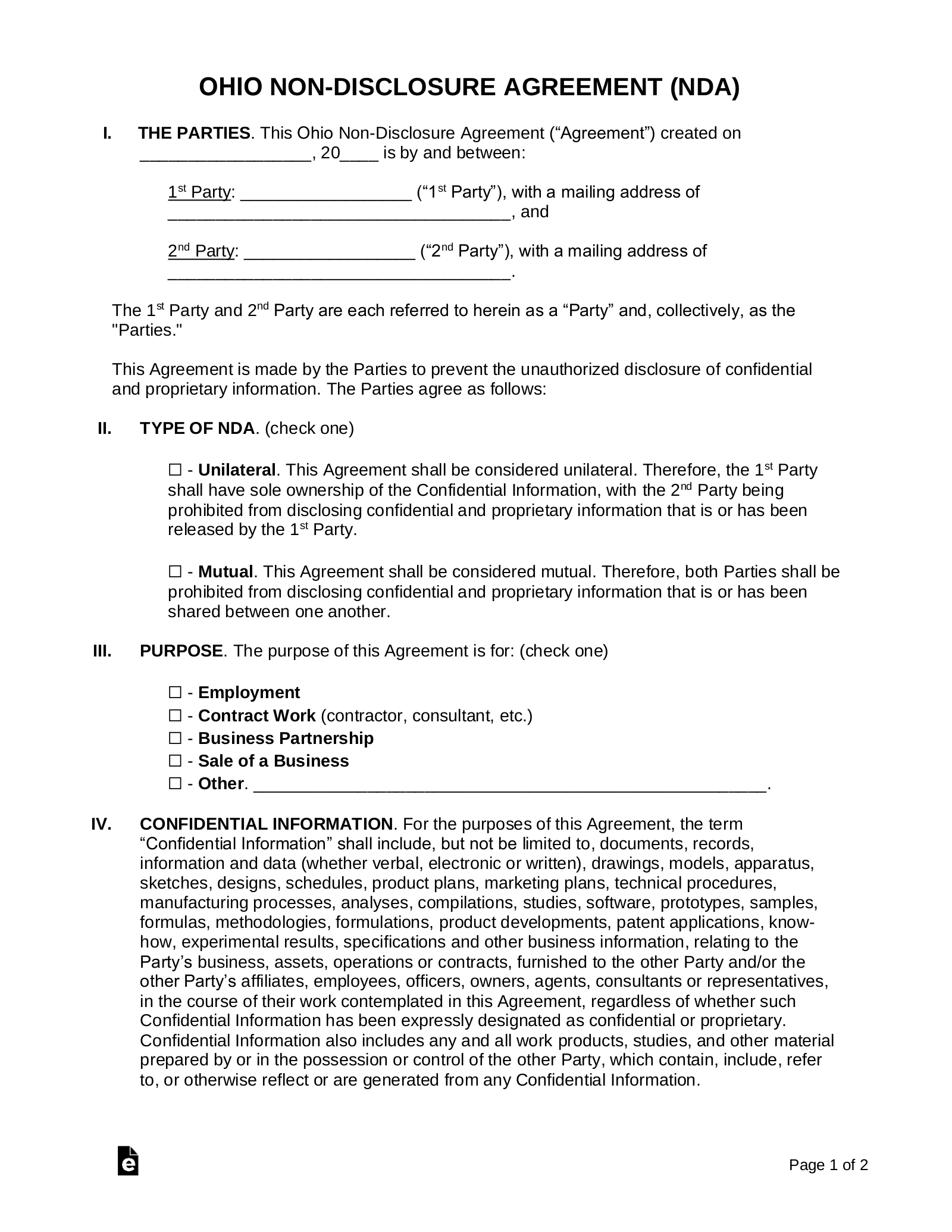

Employee Non-Disclosure Agreement (NDA) – Protects important business information from being released by the employee.

Download: PDF, MS Word, OpenDocument

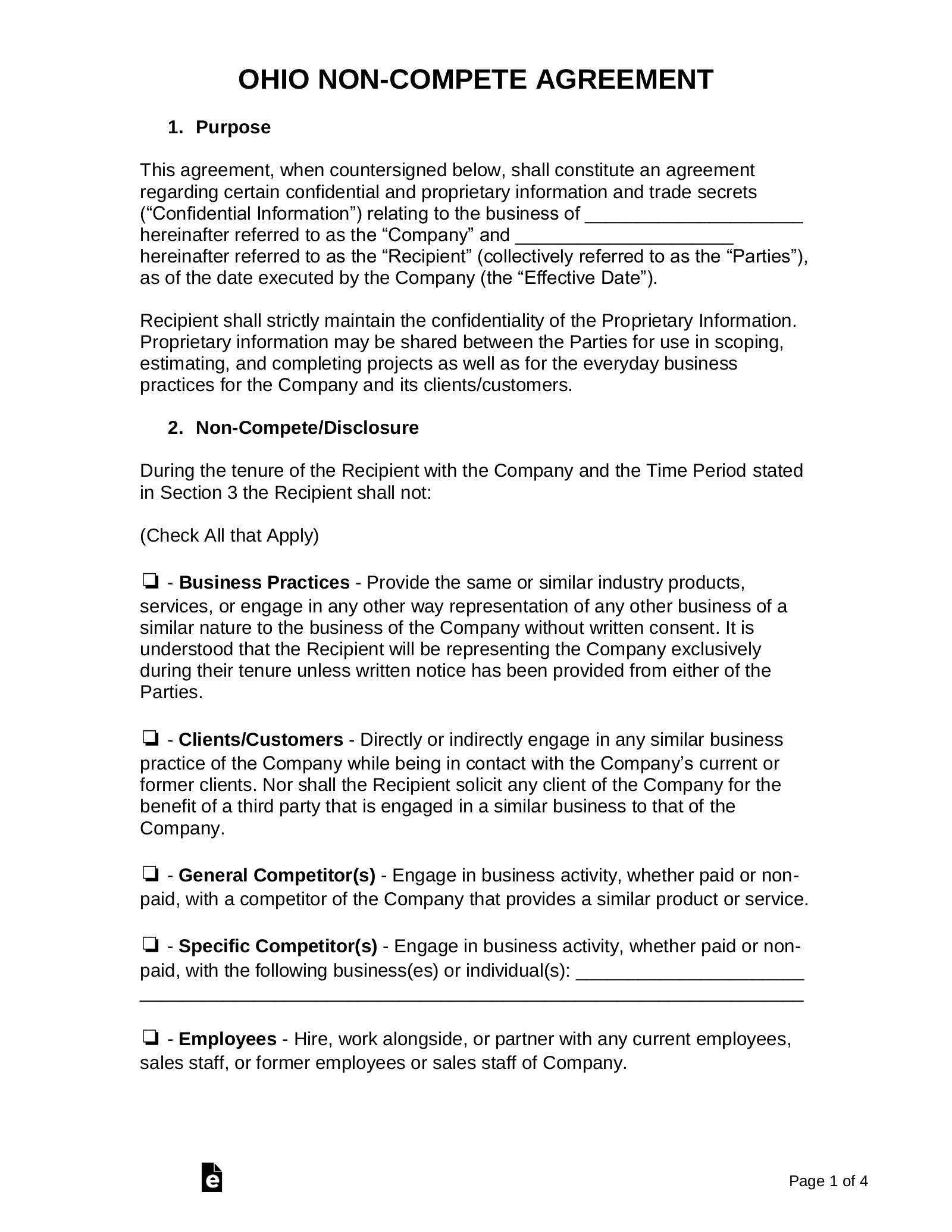

Employee Non-Compete Agreement – Stops the employee from starting new business relationships with competing businesses.

Download: PDF, MS Word, OpenDocument

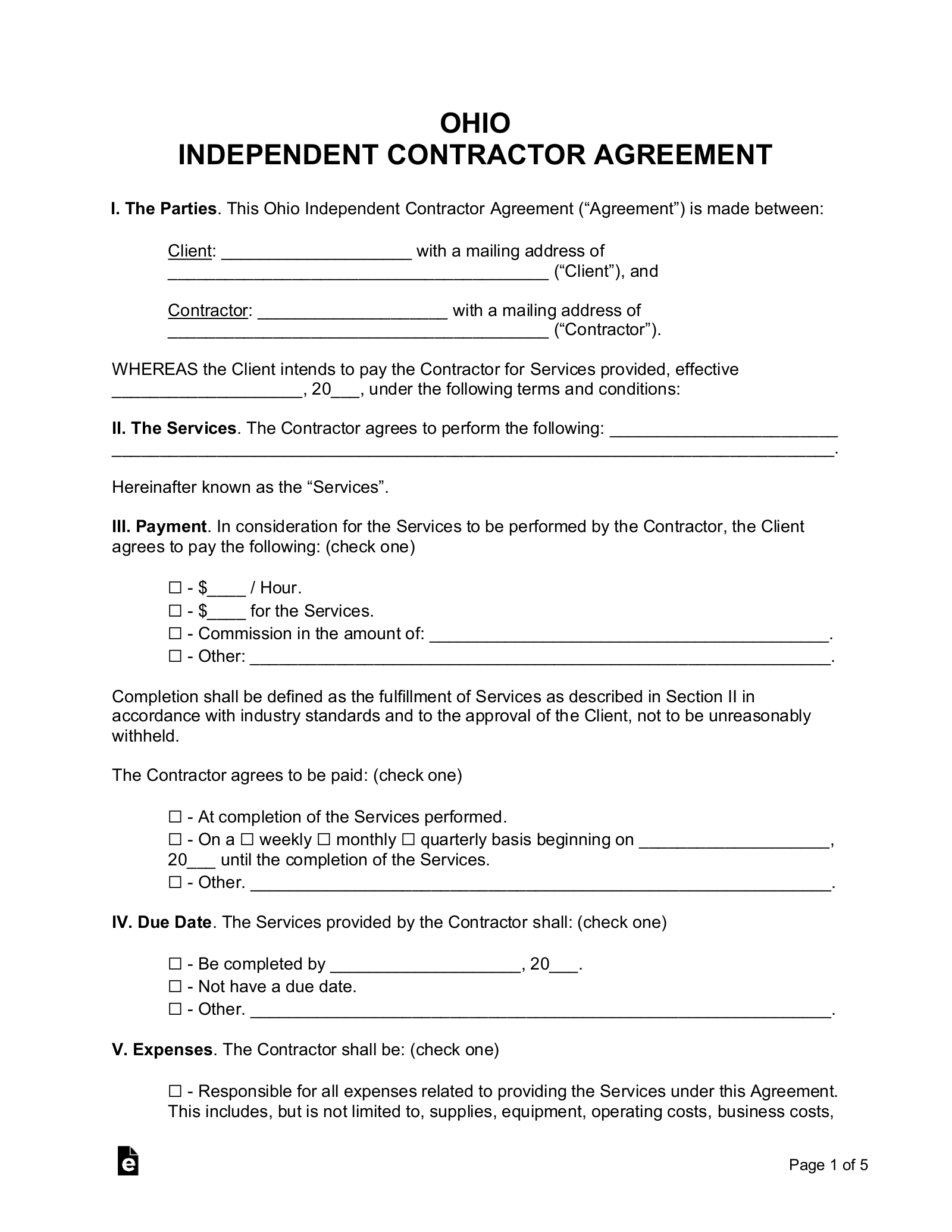

Independent Contractor Agreement – Establishes the relationship between a hiring party and an independent contractor.

Download: PDF, MS Word, OpenDocument

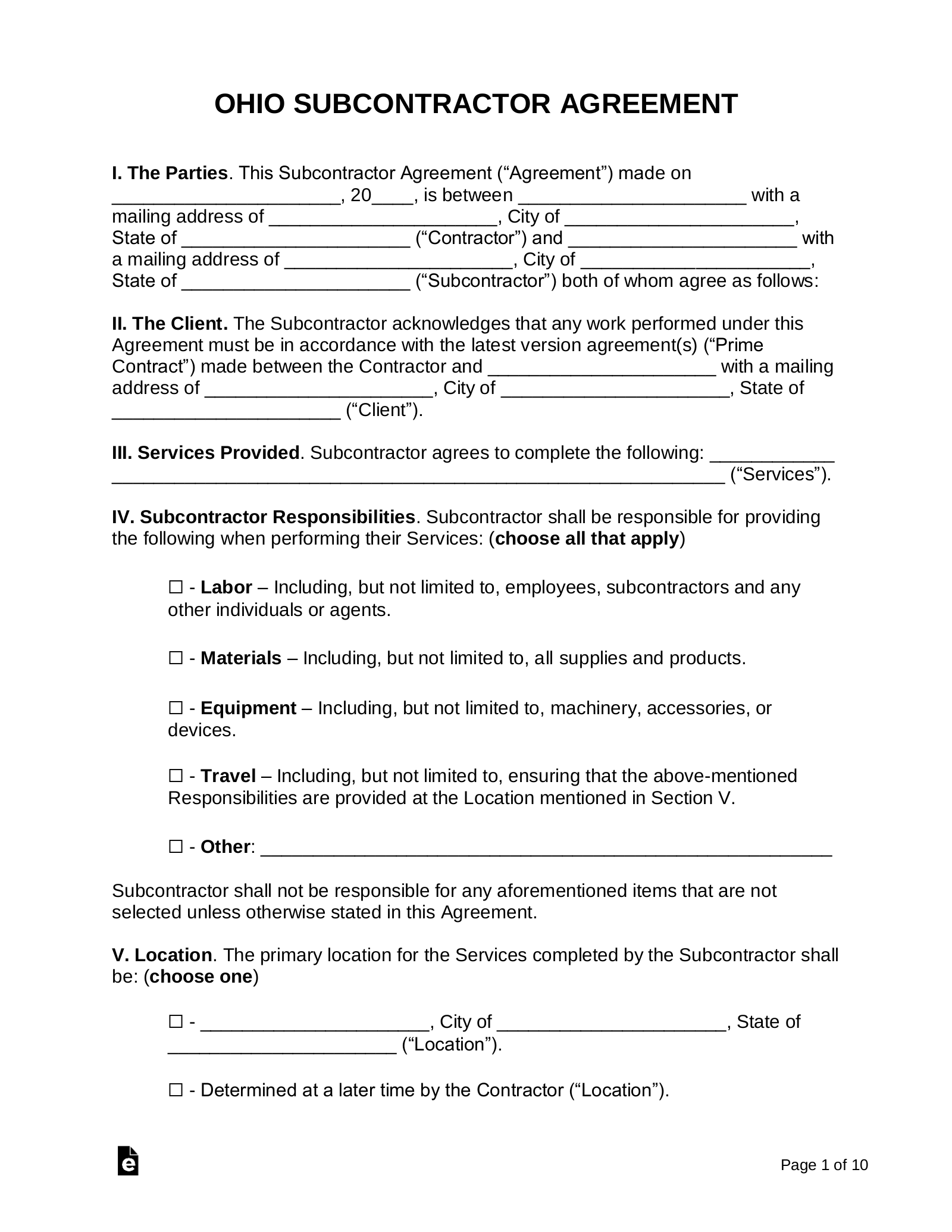

Subcontractor Agreement – Outlines the working conditions for a subcontractor assisting another in performing their hired obligations.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” and “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 2.850% to 4.797%[2]

Minimum Wage ($/hr)

Minimum Wage – $8.70 (employers earning $319,000+/year) / $7.25 (employers earning less than $319,000/year)[3]