Updated August 02, 2023

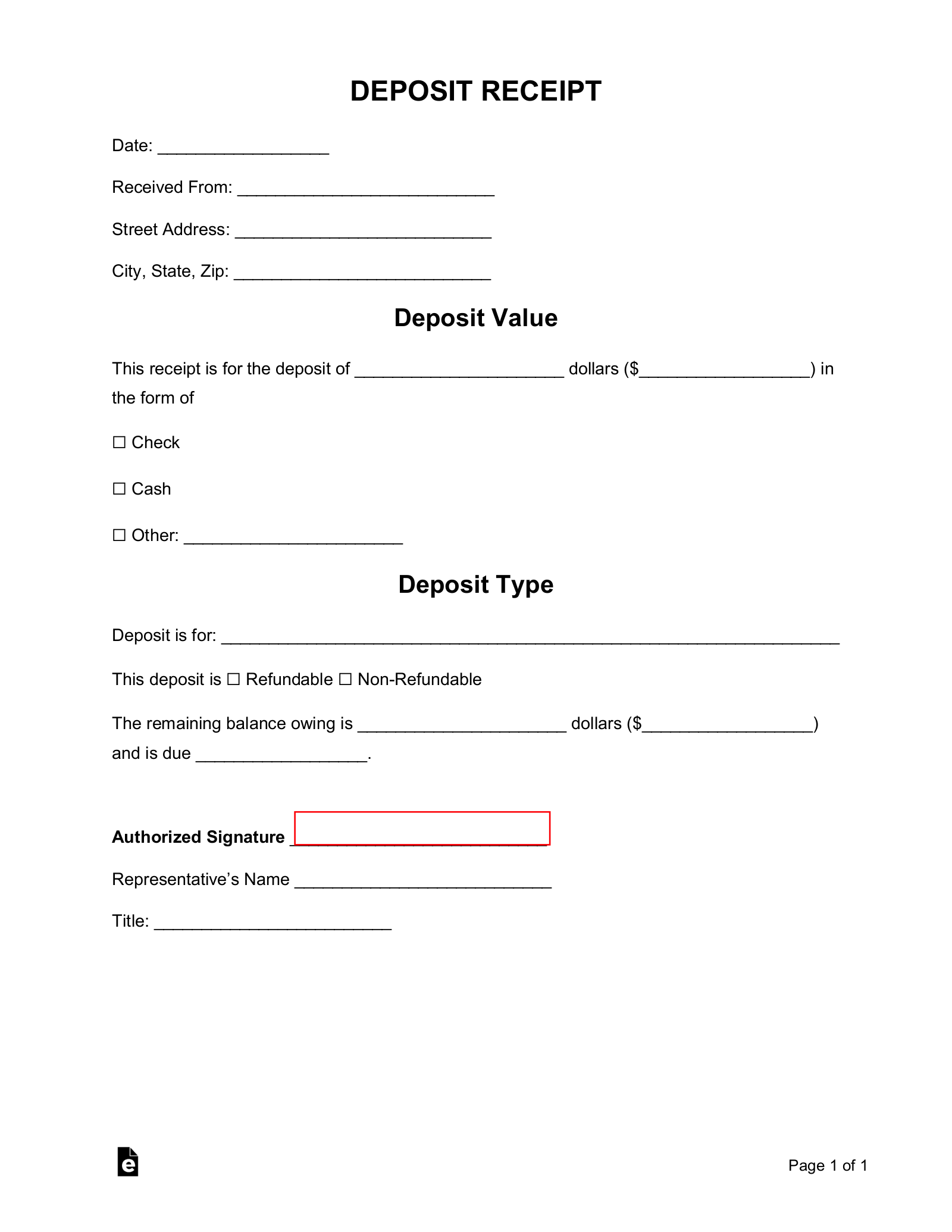

A deposit receipt is issued to a payer after funds have been received with payment of the remaining balance to be made at a later time. The deposit represents good faith by the payer with the intention of paying the full amount owed for the goods or services at a later time. The deposit, also referred to as a “downpayment”, may be refundable depending on the terms.

By Type (10)

- Car (Vehicle) Downpayment

- Cat (Kitten) Deposit

- Boat Deposit

- Dog (Puppy) Deposit

- Earnest Money Deposit

- Key Deposit

- Photography Deposit

- Real Estate Down Payment

- Security Deposit (Tenant)

- Car (Vehicle) Purchase Deposit

Table of Contents |

What is a Deposit?

A deposit is used as security for the good-faith effort to commit and follow through on an agreement or purchase. For purchasing, such as an automobile, a deposit is commonly made to hold the vehicle so the dealership does not sell the car to someone else. For landlords, a deposit is kept until the lease ends with the lease being returned if there is no damage on the property.

How Does a Deposit Work? (3 steps)

- Step 1 – The Parties Negotiate an Agreement

- Step 2 – Payer Completes the Deposit

- Step 3 – Payer Fulfills Their Duties

Step 1 – The Parties Negotiate an Agreement

The buyer and seller, or landlord and tenant, negotiate the terms of an agreement along with the amount that will be required as the deposit. Depending on the terms of the agreement, the deposit may be refundable upon the agreement being fulfilled by the payer or at the end of the tenant’s lease agreement.

- Buyers – The deposit is also known as a “downpayment” on the item, service, or real estate being purchased.

- Tenants – The deposit is also known as the “security deposit” and if often returned at the end of the tenancy if the property was properly maintained.

Step 2 – Payer Completes the Deposit

After an agreement has been completed and signed a deposit will be made. After payment is complete the payer should be furnished with a deposit receipt, especially for cash payments, that proves the funds were successfully delivered. Most agreements have a deadline, between one (1) to five (5) business days, for the deposit to be made or the agreement will be considered void.

Step 3 – Payer Fulfills their Duties

The payer will be obligated to fulfill their duties in connection with the deposit. Whether this is to complete the purchase on a product, service, or if it’s a rental property, the obligations of the payer must be met or the deposit will most likely be non-refundable.