Updated March 17, 2024

A transfer on death deed (TODD) transfers ownership of real property to another person or entity after the owner’s death. Transfer on death deeds have become increasingly popular in recent years because they provide certainty about what will happen to property while avoiding the time and expense of the probate process.

Uniform Real Property TOD Act

The Uniform Real Property Transfer on Death Act is an influential model law that many states have enacted or modified to enable residents to use transfer on death deeds.

By State (30 Allowed)

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Hawaii

- Illinois

- Indiana

- Kansas

- Maine

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Ohio

- Oklahoma

- Oregon

- South Dakota

- Texas

- Utah

- Virginia

- Washington DC

- Washington

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

What is a Transfer on Death Deed?

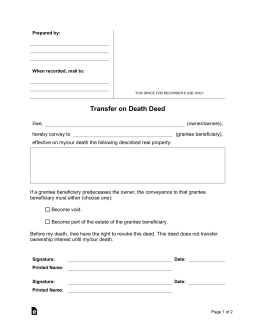

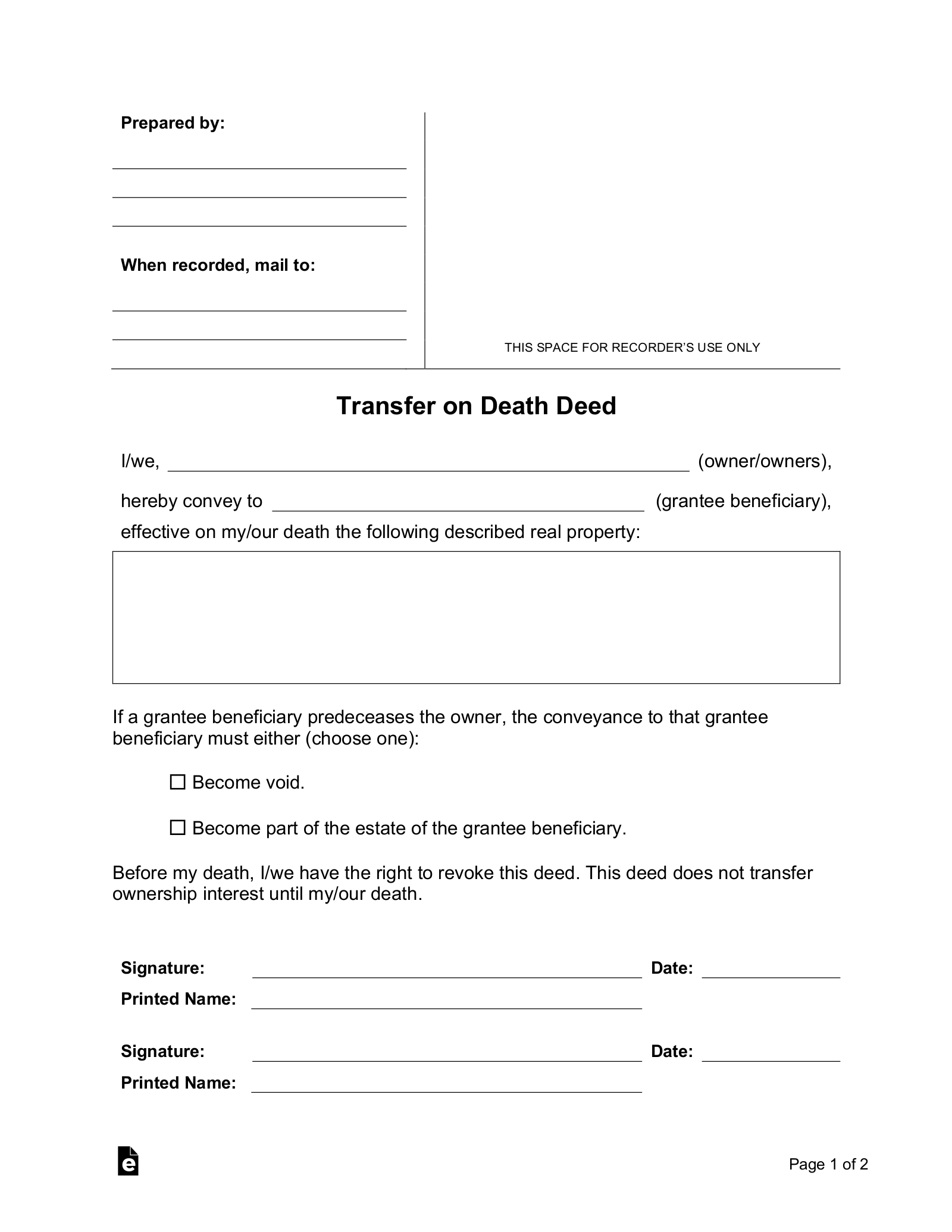

A transfer on death deed is a legal document that enables the change of ownership of real property on the death of the property’s owner. Depending on the state, a transfer on death deed may also be referred to as a “beneficiary deed” or a “deed upon death.”

Under a transfer on death deed, an owner, also called a grantor, selects a person or entity to receive real property. This party is known as either a beneficiary or a grantee. It’s also common for these deeds to identify an alternate beneficiary or grantee who would receive the property if the first beneficiary or grantee dies before the owner.

Will vs. TODDs

The effect of a transfer on death deed is similar to that of a last will and testament but saves costs. Property in a will must go through probate, which can be lengthy and expensive: In California, for example, an estate worth $600,000 would face representative and attorney fees of $30,000. Property passed through a TODD avoids probate, and the beneficiary takes ownership of the property, usually when the death certificate is recorded.

Creditors and Debts

If a property has a lien when the owner creates a transfer on death deed, the beneficiary will be subject to that lien. The following will still remain with the property after it is transferred after death:

- Mortgages

- Liens

- Encumbrances

- Other debts

Property covered by a transfer on death deed cannot be reached by a beneficiary’s creditors before the owner’s death. For example, John creates a transfer on death deed, giving property X to Brenda. Later, Brenda is sued and declares bankruptcy. The person suing Brenda cannot use X to satisfy their claim until the property has passed over.

Taxes

In some states and jurisdictions, transfer taxes may apply to TODD deeds, while in others, they may be exempt. Moreover, since the beneficiary does not own the property until the grantor’s death, they would not be liable for property taxes until the transfer.

Unauthorized States

The 20 states that DO NOT currently allow the use of transfer on death deeds are: Alabama, Connecticut, Delaware, Florida, Georgia, Idaho, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, and Tennessee.

Ohio formerly allowed TODDs but now permits a transfer on death designation affidavit. Deeds executed and recorded before December 28, 2009, remain valid. Vermont offers a statutory enhanced life estate deed. Florida and Michigan recognize the “Lady Bird deed,” a similar way of transferring ownership.

Currently Pending: Connecticut, Delaware, Kentucky, New Hampshire, North Carolina, and Rhode Island.

Other Ways to Avoid Probate

For those in states where transfer on death deeds are not yet allowed, there are other options to avoid probate.

- Joint tenancy or tenancy by the entirety: A joint tenancy and a tenancy by the entirety resemble a transfer on death deed in that they automatically make another party the sole owner of a property following another’s death, but works by changing the status of property while an owner is still alive. Tenancies by the entirety are only available for spouses.

- Revocable Living Trust: A revocable living trust is a legal instrument that holds property and is subject to instructions about how to distribute it. Trusts can hold many different types of property.

- Small Estate Affidavit: A small estate affidavit is designed for use after a property’s owner has already died. By filing a small estate affidavit, someone who is entitled to a decedent’s property can get access to it more quickly and affordably.

As the name implies, small estate affidavits are for small amounts of property, and many states set a maximum value for their use that is less than the value of a typical home, or prohibit their use for land entirely. And, as explained below, both trusts and tenancy modifications have drawbacks.

Recording Information (All States)

| State | TODD Authorized? | When to Record |

|---|---|---|

| Alabama | No | N/A |

| Alaska | Yes (Alaska Stat. Ann. §§ 13.48.010-13.48.195) |

Before transferor’s death. (§ 13.48.050(4)) |

| Arizona | Yes; known as a “beneficiary deed” (A.R.S. § 33-405) |

Before transferor’s death. (A.R.S. § 33-405(E)) |

| Arkansas | Yes; known as a “beneficiary deed” (Ark. Code Ann. § 18-12-608) |

Before transferor’s death. (Ark. Code Ann. § 18-12-608(c)(1)) |

| California | Yes (Cal. Prob. Code §§ 5600 to 5698) |

On or before 60 days after deed was notarized. (Cal. Prob. Code § 5626) |

| Colorado | Yes; known as a “beneficiary deed” (Colo. Rev. Stat. Ann. §§ 15-15-401 to 15-15-415) |

Before transferor’s death. (Colo. Rev. Stat. Ann. § 15-15-404)

|

| Connecticut | No | N/A |

| Delaware | No | N/A |

| Florida | No | N/A |

| Georgia | No | N/A |

| Hawaii | Yes (HRS §§ 527-1 to 527-17) |

Before transferor’s death. (HRS § 527-9) |

| Idaho | No | N/A |

| Illinois | Yes; known as a “transfer on death instrument” (TODI) (755 ILCS 27/1 to 27/95) |

Before transferor’s death. (755 ILCS 27/40(a)(3)) |

| Indiana | Yes (Ind. Code § 32-17-14-11) |

Before transferor’s death. (Ind. Code § 32-17-14-11(a), (b)) |

| Iowa | No | N/A |

| Kansas | Yes (K.S.A. 59-3501 to 59-3507) |

Before transferor’s death. (K.S.A. 59-3502) |

| Kentucky | No | N/A |

| Louisiana | No | N/A |

| Maine | Yes (18-C M.R.S.A. §§ 6-401 to 6-420) |

Before transferor’s death. (18-C M.R.S.A. § 6-409) |

| Maryland | No | N/A |

| Massachusetts | No | N/A |

| Michigan | No | N/A |

| Minnesota | Yes (Minn. Stat. Ann. § 507.071) |

Before transferor’s death. (Minn. Stat. Ann. § 507.071, subd. 8) |

| Mississippi | Yes (Miss. Code Ann. §§ 91-27-1 to 91-27-37) |

Before transferor’s death. (Miss. Code Ann. § 91-27-17(3)) |

| Missouri | Yes; also known as a beneficiary deed (§ 461.025, RSMo) |

Before transferor’s death. (§ 461.025, RSMo) |

| Montana | Yes (Mont. Code Ann. §§ 72-6-401 to 72-6-418) |

Before transferor’s death. (Mont. Code Ann. § 72-6-408) |

| Nebraska | Yes (Neb. Rev. St. §§ 76-3401 to 76-3423) |

Within 30 days of being executed, and before transferor’s death. (Neb. Rev. St. § 76-3410(a)(4)) |

| Nevada | Yes; known as a “deed upon death” (NRS 111.655 to 111.699) |

Before transferor’s death. (NRS 111.681) |

| New Hampshire | No | N/A |

| New Jersey | No | N/A |

| New Mexico | Yes (NMSA 1978, §§ 45-6-401 to 45-6-417) |

Before transferor’s death. (NMSA 1978, § 45-6-409) |

| New York | No | N/A |

| North Carolina | No | N/A |

| North Dakota | Yes (N.D.C.C. §§ 30.1-32.1-01 to 30.1-32.1-14) |

Before transferor’s death. (N.D.C.C. § 30.1-32.1-06(4)) |

| Ohio | Ohio no longer authorizes TODDs by statute but instead authorizes a transfer on death designation affidavit that alleviates some flaws of TODDs. TODDs executed and recorded before Dec. 28, 2009 remain valid. | Before transferor’s death. (Ohio R.C. 5302.22(F)) |

| Oklahoma | Yes (Okla. Stat. tit. 58, §§ 1251 to 1258) |

Before transferor’s death. (Okla. Stat. Ann. tit. 58, § 1253) |

| Oregon | Yes (Or. Rev. Stat. §§ 93.948 to 93.985) |

Before transferor’s death. (Or. Rev. Stat. § 93.961(1)(d)) |

| Pennsylvania | No | N/A |

| Rhode Island | No | N/A |

| South Carolina | No | N/A |

| South Dakota | Yes (SDCL 29A-6-401 to 29A-6-435) |

Before transferor’s death. (SDCL 29A-6-408) |

| Tennessee | No | N/A |

| Texas | Yes (Tex. Est. Code Ann. §§ 114.001 to 114.106) |

Before transferor’s death. (Tex. Est. Code Ann. § 114.055(3)) |

| Utah | Yes (Utah Code §§ 75-6-401 to 75-6-419) |

Before transferor’s death. (Utah Code § 75-6-409(3)) |

| Vermont | No, but has statutory enhanced life estate deed, under Enhanced Life Estate Deed Act. (27 V.S.A. §§ 651 to 660) |

N/A |

| Virginia | Yes (Va. Code Ann. §§ 64.2-621 to 64.2-638) |

Before transferor’s death. (Va. Code Ann. § 64.2-628) |

| Washington | Yes (RCW 64.80.010 to 64.80.904) |

Before transferor’s death. (RCW 64.80.060) |

| Washington D.C. | Yes (D.C. Code §§ 19-604.01 to 19-604.19) |

Before transferor’s death. (D.C. Code § 19-604.09(c)) |

| West Virginia | Yes (Va. Code §§ 36-12-1 to 36-12-17) |

Before transferor’s death. (Va. Code § 36-12-9) |

| Wisconsin | Yes (Wis. Stat. § 705.15) |

For property with one owner, before the death of the sole owner and for property with multiple owners, before the death of last surviving owner. (Wis. Stat. § 705.15(2)(c)) |

| Wyoming | Yes (Wyo. Stat. Ann. §§ 2-18-101 to 2-18-106) |

Before transferor’s death. (Wyo. Stat. Ann. § 2-18-103(e)) |

When to Use

Transfer on death deeds are an ideal solution for many U.S. households, including:

-

- Those who own a home but have few other substantial assets. In this situation, creating a transfer on death deed means that the bulk of an estate will pass quickly and easily to the intended beneficiary.

- Those who want to avoid probate but also save on legal fees. Transfer on death deeds are much more affordable to create than revocable trusts, which are complex and expensive to create. Many property owners create transfer on death deeds on their own, but even those that do hire an attorney to assist with preparing one are likely to face smaller legal fees than they would creating a trust.

-

- Those who may want to alter the deeded property. Unlike transfer on death deeds, creating a joint tenancy or a tenancy by the entirety changes the legal status of property while the owner is alive. If the owner of a property wants to make major changes, such as tearing down a structure, it may be necessary to get the other party’s approval. With a transfer on death deed, owners remain free to modify the property as they see fit.

Disadvantages

All deeds and modifications are recorded, which makes the information public. Those not wanting the transfer on public record may want to consider another method. Additionally, TODDs may not be right for complex estates. If someone owns land in multiple states, a trust may make it easier to administer the estate. Trusts are generally not on public record.

Revocation

Another benefit of transfer on death deeds is that they can be changed or revoked at any time. There are three ways to revoke a transfer on death deed:

- File a revocation form. This will usually be available from the same office where the deed was recorded.

- Complete a new transfer on death deed for the same property. The deed should be recorded in the same office as the original transfer on death deed.

- Transfer the property through another type of deed. The owner may use a different type of deed, such as a quitclaim deed, and state somewhere in the deed that it is revoking the previous transfer on death deed.

Revoking a transfer on death deed must happen while the owner is alive; a will cannot be used to revoke a transfer on death deed.

Notarization

Like all deeds, transfer on death deeds must be notarized before they are recorded. The grantor will always have to sign the document, and some states or localities may require the beneficiary or witnesses to sign the deed as well.

After notarization, the transfer on death deed should be taken to the local county clerk’s office to record the deed.