Updated September 26, 2023

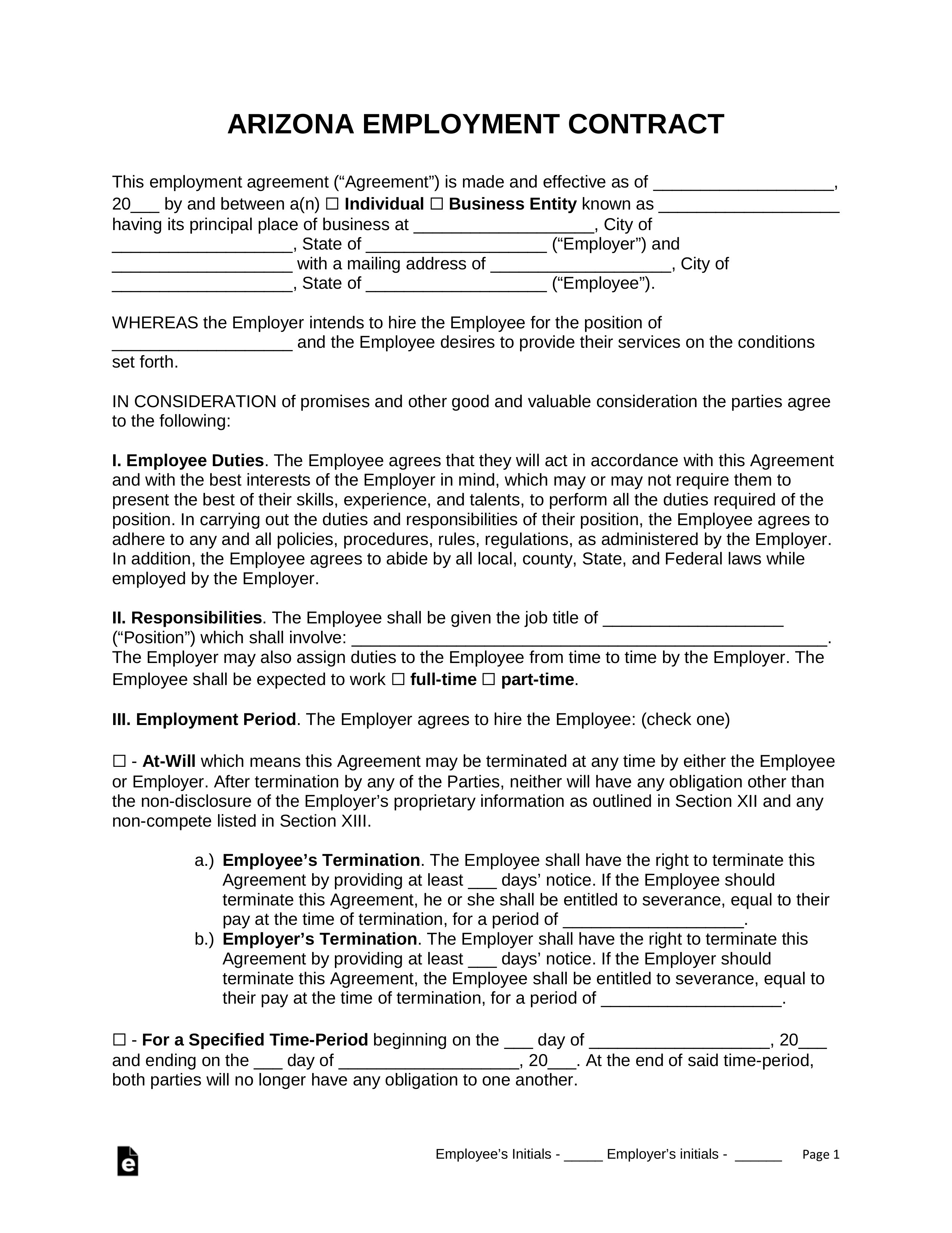

An Arizona employment contract agreement is a document used to create a legal bond between an employer and an employee. The agreement contains information on the employee’s job including duties, pay, benefits, and employment period, and also protects the employer through non-disclosure and non-compete clauses. Signing this type of document establishes a clear-cut relationship between employee and employer, ensuring that both parties remain privy to each other’s intentions and expectations. Although these contracts are more useful for employees with high-level jobs, they can be applied to any position of any job type (permanent employee, contractor, or subcontractor).

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Holds employees liable for maintaining the confidentiality of the employer’s proprietary information and trade secrets.

Employee Non-Disclosure Agreement (NDA) – Holds employees liable for maintaining the confidentiality of the employer’s proprietary information and trade secrets.

Download: PDF, MS Word (.docx), OpenDocument

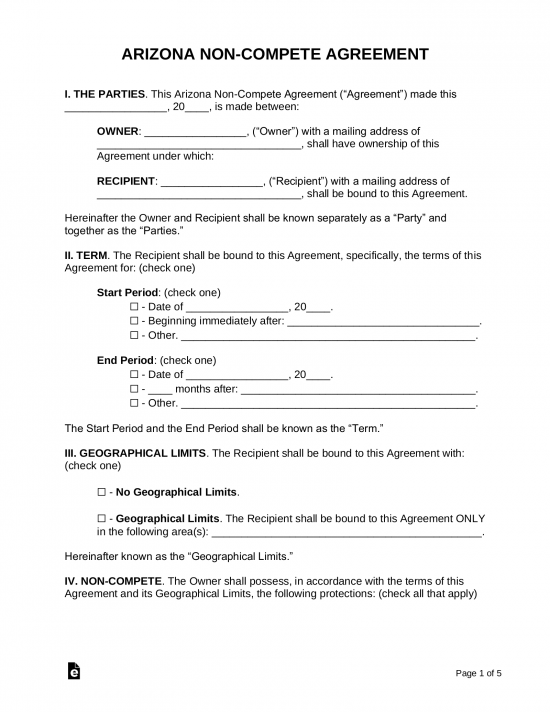

Employee Non-Compete Agreement – Prohibits an employee from starting a business or aiding an existing business (during employment or upon termination) that directly competes with the employer’s company and field of business.

Employee Non-Compete Agreement – Prohibits an employee from starting a business or aiding an existing business (during employment or upon termination) that directly competes with the employer’s company and field of business.

Download: PDF, MS Word (.docx), OpenDocument

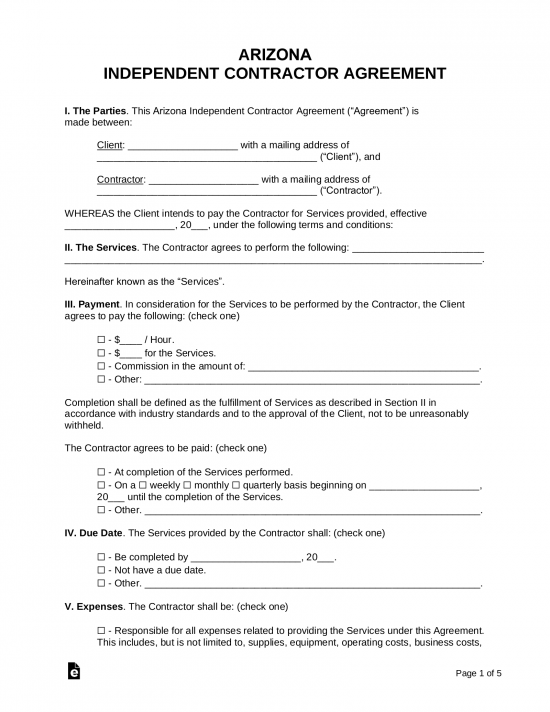

Independent Contractor Agreement – Binding document between client and independent contractor for the duration of a project or task.

Independent Contractor Agreement – Binding document between client and independent contractor for the duration of a project or task.

Download: PDF, MS Word (.docx), OpenDocument

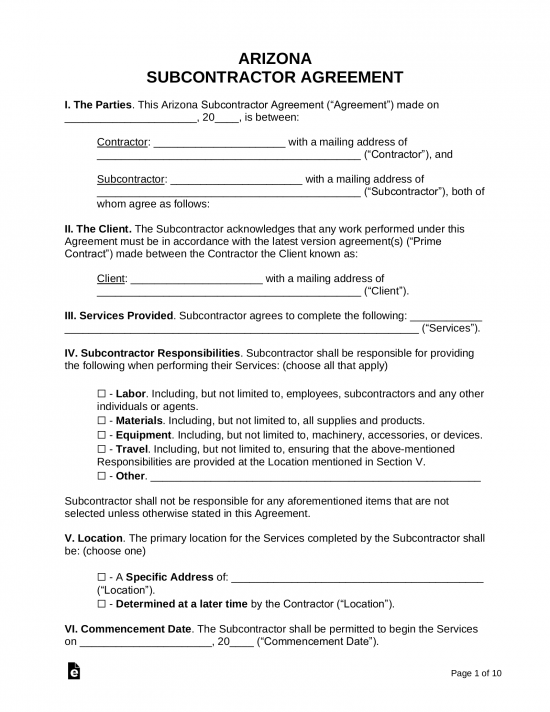

Subcontractor Agreement – Binding document between contractor and subcontractor for the duration of a project or task.

Subcontractor Agreement – Binding document between contractor and subcontractor for the duration of a project or task.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition – Any person who provides services or labor for an employer in the state of Arizona for wages or remuneration. This definition does not include independent contractors.[1]

At-Will Employment

Allowed with the exception of “Public Policy,” “Implied Contracts” and “Good-Faith” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 2.59% to 4.50%[2]

Minimum Wage ($/hr)

Minimum Wage – $12.00[3]