By Type (7)

Standard Residential Lease Agreement – Most popular type of residential lease. Fixed-term arrangement lasting for a one-year period. Standard Residential Lease Agreement – Most popular type of residential lease. Fixed-term arrangement lasting for a one-year period.

Download: PDF, MS Word, OpenDocument |

Association of Realtors Lease – For use by a licensed realtor in the State of Minnesota. Association of Realtors Lease – For use by a licensed realtor in the State of Minnesota.

Download: PDF |

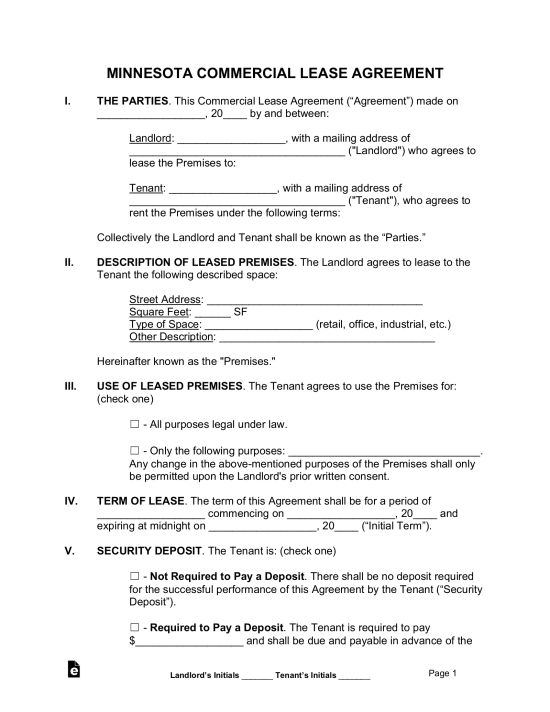

Commercial Lease Agreement – Intended for a property with commercial use such as retail, restaurant, office, or industrial types. Commercial Lease Agreement – Intended for a property with commercial use such as retail, restaurant, office, or industrial types.

Download: PDF, MS Word, OpenDocument |

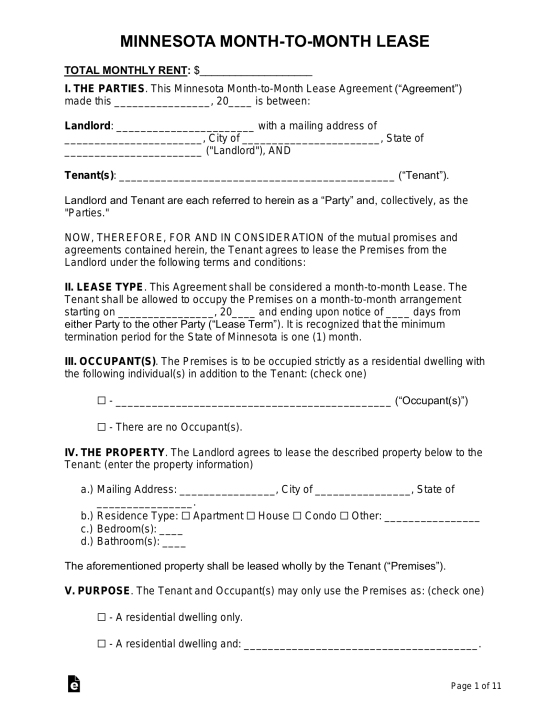

Month-to-Month Lease Agreement – Must be written pursuant to § 504B.135 with the cancellation of the contract within the payment interval or three months, whichever is less. Month-to-Month Lease Agreement – Must be written pursuant to § 504B.135 with the cancellation of the contract within the payment interval or three months, whichever is less.

Download: PDF, MS Word, OpenDocument |

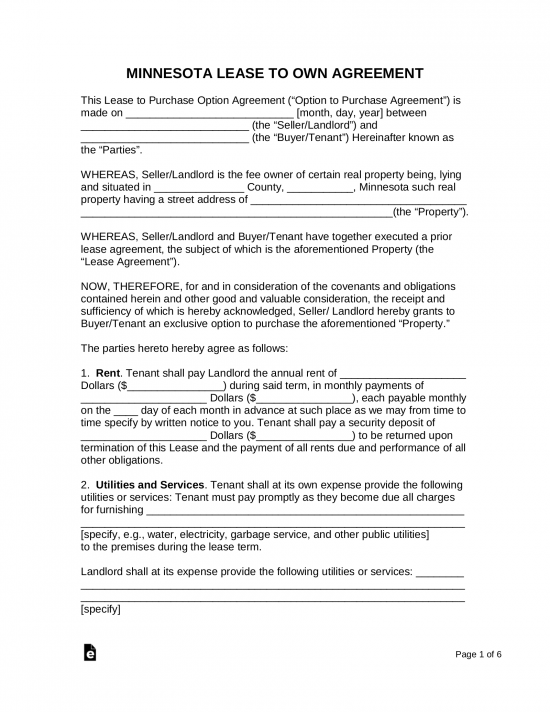

Rent-to-Own Lease Agreement – Typical contract with the added benefit of having the choice of buying the property. Rent-to-Own Lease Agreement – Typical contract with the added benefit of having the choice of buying the property.

Download: PDF, MS Word, OpenDocument |

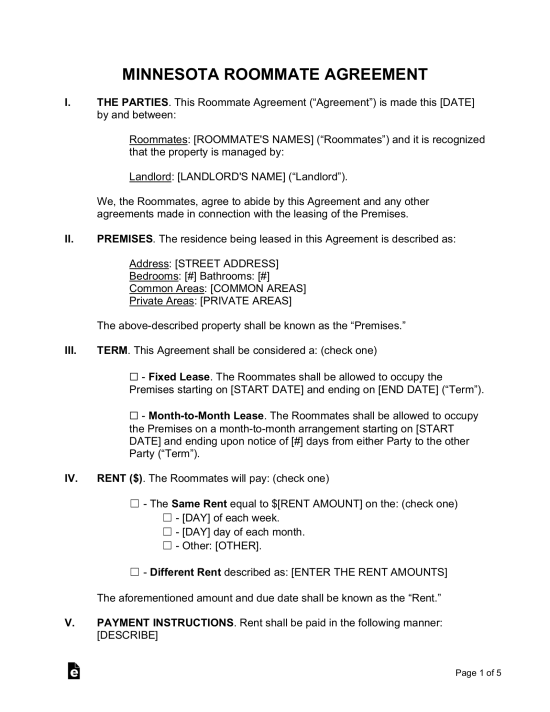

Room Rental (Roommate) Agreement – For persons designated in a shared living arrangement. Room Rental (Roommate) Agreement – For persons designated in a shared living arrangement.

Download: PDF, MS Word, OpenDocument |

Sublease Agreement – For the renting of space that is already under an agreement by a tenant. Sublease Agreement – For the renting of space that is already under an agreement by a tenant.

Download: PDF, MS Word, OpenDocument |

Required Disclosures (6)

- Covenant of Landlord and Tenant Not to Allow Unlawful Activities – All residential lease agreements written in Minnesota must include specific covenants indicating that both the landlord and the tenant promise not to allow certain unlawful activities to occur within the premises.[1]

- Financial Distress (conditional) – If the landlord’s property is being foreclosed upon or a deed of cancellation has been issued, a tenant may not legally sign for more than a two-month period.[2]

- Landlord/Manager Information – In the lease agreement, the landlord must disclose the manager authorized to act on the premises and an address for notices.[3]

- Lead-Based Paint Disclosure & EPA Pamphlet – This disclosure form is required by federal law for all tenants moving into properties constructed before 1978.

- Outstanding Inspection Orders (conditional) – If the premises have any outstanding inspection orders due to a property’s code infraction, this information must be relayed to the tenant.[4]

- Disclosure of Fees – Landlords must disclose to tenants all non-optional fees. The sum of the total rent and all mandatory fees must be described as the “Total Monthly Payment” on the first page of the lease agreement.[5]

Security Deposits

Maximum Amount – Minnesota state law does not establish a maximum amount for security deposits.

Collecting Interest – The landlord must hold the tenant’s security deposit in an account bearing simple non-compounded interest at a rate of 1% per annum.[6]

Returning – The landlord must return the security deposit, with interest, to the tenant within three weeks of the termination of tenancy.[6]

- Itemized List – If the landlord withholds any portion of the security deposit, they must furnish a written statement to the tenant outlining the specific reason for the withholding.[6]

- Move-In Inspection – When a landlord receives a security deposit, they must notify their tenants of the option to request and conduct an initial move-in inspection.

- The landlord can either notify the tenant at the start of the tenancy or within 14 days of the tenant’s move-in date.[7]

When is Rent Due?

Grace Period – Minnesota state law does not establish a grace period for paying rent. Rent is due on the date mentioned in the lease.

Maximum Late Fee – Late fees must be established in the lease agreement and may not exceed 8% of the monthly rent.[8]

NSF Fee – There is no Minnesota law regarding fees for NSF rent checks. However, the fee should be named in the lease agreement and must be reasonable.

Withholding Rent – A tenant may withhold rent and deposit it with a court administrator if there is a need for repairs to the unit and the landlord has been given written notice.[9]

Right to Enter (Landlord)

Standard Access – The landlord must give 24-hours’ notice before entering the property. The notice must also specify a time and window of entry, which must be between 8:00 a.m. and 8:00 p.m unless otherwise agreed.[10]

Immediate Access – The landlord may enter the property without notice if they reasonably believe that immediate entry is necessary to prevent injury, determine the tenant’s safety, or comply with local ordinances regarding unlawful activity.[10]

Abandonment

Absence – Minnesota state law does not establish a set length of time that a tenant must be absent for a unit to be considered abandoned.

Breaking the Lease – If a tenant’s health requires them to relocate to a medical care facility, then they may break the lease without penalty. The tenant, or their authorized representative, must give the landlord two months’ notice before breaking the lease.[11]

Tenant’s Utility Shutoff – If utilities are included in the rent, or if a landlord who directly pays for utilities bills the tenant for these costs, and the tenant fails to pay this bill, then the landlord may bring an eviction action for nonpayment.[12]

Unclaimed Property – If a tenant abandons a rental property, the landlord must store and care for any abandoned personal property for at least 28 days. After this time, the landlord may dispose of the property.[13]