Updated August 03, 2023

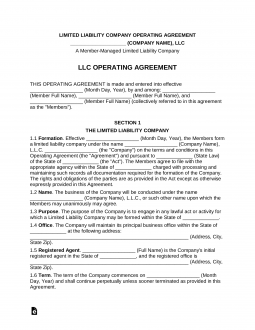

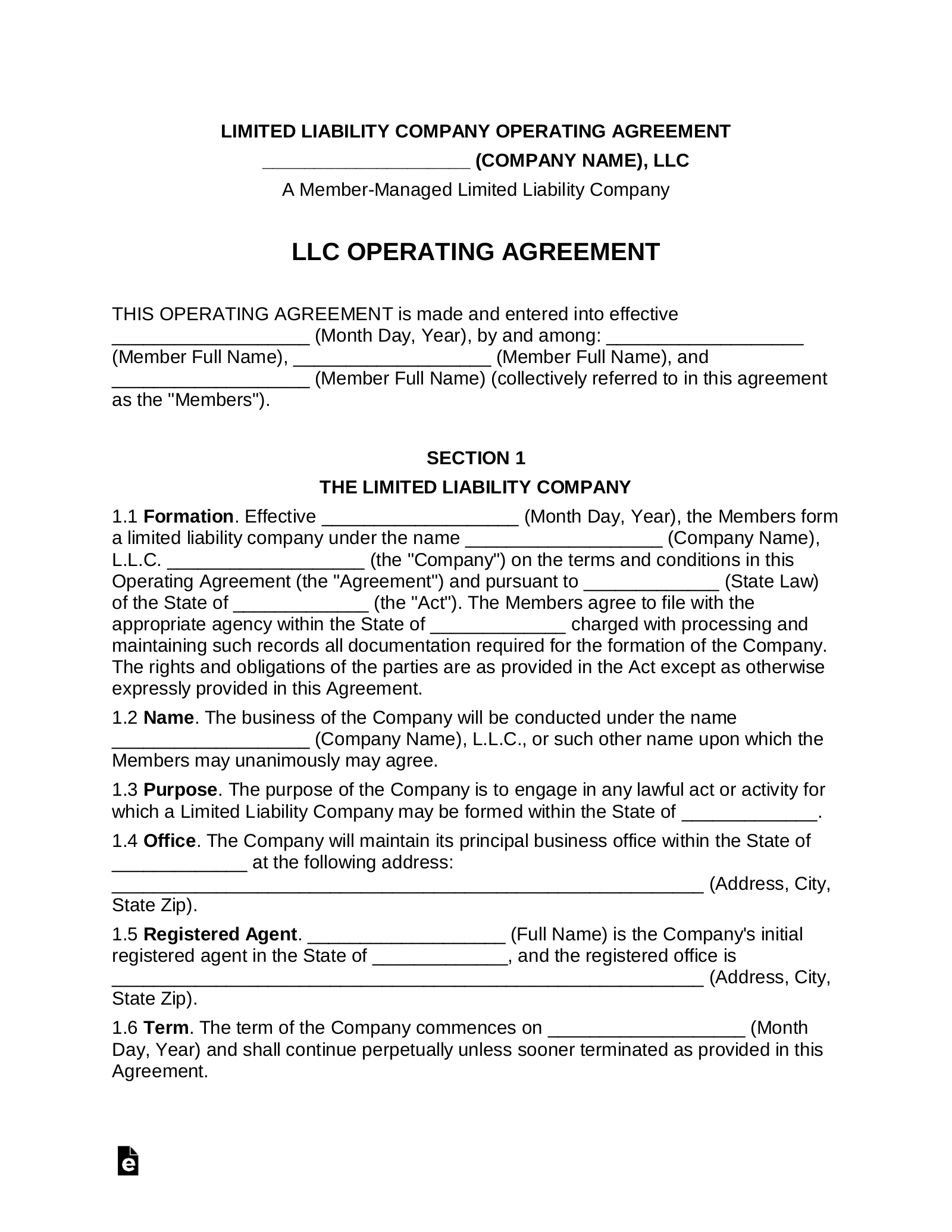

A multi-member LLC operating agreement is a binding document between the members of a company that includes terms related to ownership (%), management, and operations. The agreement should be created when forming the company as an understanding of how the organization will run. To be effective, all members are required to sign the operating agreement.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Key Terms (10)

The following terms and clauses should be mentioned in an operating agreement for the best interest of each member:

Ownership

The ownership of an LLC is mentioned as a percentage (%) since there are no shares in a company. Each member’s ownership interest should be mentioned and, if there are different classes of owneship, such limited powers should be detailed.

Registered Agent

A registered agent is the person that will receive official notices on behalf of the company. It is recommended for the registered agent to be the company’s legal counsel, not a member.

The registered agent should be the same person in the operating agreement as listed with the Secretary of State’s office.

Capital Contributions

A capital contribution is a recognized transfer of assets or cash made to the LLC. This may be in exchange for ownership but does not need to be mentioned in the agreement.

Capital contributions made by members are not paid back by the LLC. If a member wants to loan the LLC money, a separate loan agreement should be written.

Management

There are 2 types of LLC management;

- Member-Managed (most common) – When the members play an active role in the day-to-day decisions of the business.

- Manager-Managed – When the members, like a board of directors, choose individuals to run the company.

No matter which type is selected, the members should include the terms under which decisions are made. A simple majority of 51% ownership interest is the most common.

Meetings

An annual meeting should be mentioned in an operating agreement that will occur within 30 days notice to all the members. Even though this meeting may never take place in real life, it is recommended to be mentioned.

Accounting

The accounting practices of the company in regard to:

- When taxes will be paid (fiscal year) and who is responsible for filing;

- How the LLC will be taxed (i.e. C-Corp, S-Corp, etc.); and

- How profits will be distributed.

Right of First Refusal

A right of first refusal gives the members of a company the option to purchase a member’s ownership who has entered into a contract to sell. The other members will have, usually 30 days, to agree to the same terms under the purchase agreement.

Death of a Member

If a member dies, it’s recommended to have language that allows the members to purchase their ownership under a -pre-determined valuation. A company is best suited to have its members be active participants in the day-to-day operations of the buseinss and a “death clause” helps to mitigate such issues.

Dissolution

A dissolution is the winding up of a company’s assets and terminating its business activities. In most cases, the assets of the company will be sold at fair market value to service any debts with any excess cash to be distributed to the members.

If a company is dissolved, it must also be filed with the Secretary of State.

Non-Compete

A non-compete is recommended to ensure that no member is able to start a similar business. Even if the LLC was to dissolve, the non-compete will usually last for a period of time after the company ceased operations.

Related Forms

LLC Operating Agreement Amendment

LLC Operating Agreement Amendment

Download: PDF, MS Word, OpenDocument

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Download: PDF, MS Word, OpenDocument