Updated August 04, 2023

A single-member LLC operating agreement outlines the business activities, management, and ownership of a company with 1 owner (member). The agreement is created for formality purposes to o help solidify the company’s status as a separate entity.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

What is a Single-Member LLC?

A single-member LLC is a company with one (1) owner and is commonly created for tax planning and to separate the owner from the company’s assets and liability. All revenue that is generated by the LLC, after expenses have been properly deducted, will be “passed through” at the same tax rate as the owner’s individual basis.

IRS Definition

“An LLC is an entity created by state statute… An LLC with only one member is treated as an entity disregarded as separate from its owner for income tax purposes (but as a separate entity for purposes of employment tax and certain excise taxes), unless it files Form 8832 and affirmatively elects to be treated as a corporation.”

Single Member LLC vs Sole Proprietorship

LLC

- Free of financial and personal liability (except for gross negligence);

- Allowed to hire employees;

- Acts as a separate entity;

- Can create bank accounts;

Sole Proprietorship

- Liable for financial and personal liability;

- Not allowed to hire employees unless the owner gets an EIN;

- Does not act as a separate entity;

- Can only create bank accounts under a DBA or under a personal name.

Frequently Asked Questions (10)

- Does a single-member LLC need an operating agreement?

- How does a single-member LLC pay taxes?

- Can a single-member LLC be an S-Corp?

- Can a single-member LLC be a C-Corp?

- Can a married couple be in a single-member LLC?

- Can you sell a single-member LLC?

- Can a single-member LLC add members?

- Can a single-member LLC hire employees?

- Can a single-member LLC pay rent to the owner?

- Do single-member LLCs pay quarterly taxes?

Does a single-member LLC need an operating agreement?

Even though an operating agreement is highly recommended, it is only required in the states of California, Delaware, Maine, Missouri, and New York.

How does a single-member LLC pay taxes?

A single-member LLC does not pay taxes at the company level (unless there is a state LLC tax). The profits from an LLC are pass-through to the owner and paid on their IRS Form 1040.

Can a single-member LLC be an S-Corporation (S-Corp)?

Yes, by filing IRS Form 2553 within 75 days of the effective date or in any tax year prior to March 15th.

Can a single-member LLC be a C-Corporation (C-Corp)?

Yes, by filing IRS Form 8832.

Can a married couple be in a single-member LLC?

No. By definition, a single-member LLC only has one (1) owner. Although, adding a spouse requires amending the entity’s operating agreement which will convert it to a multi-member LLC.

Can you sell a single-member LLC?

Yes, the owner can sell the entity just like any other business.

Can a single-member LLC add members?

Yes, a single-member LLC can add members. Although, this will make the entity a multi-member LLC, which will require amending the operating agreement.

Can a single-member LLC hire employees?

Yes. The term single-member only refers to there being 1 owner. There can be as many employees as the owner desires.

Can a single-member LLC pay rent to the owner?

Yes. A single-member LLC can pay rent to the owner if, for example, the owner is also the landlord. Although the property cannot be in the same single-member LLC, it must have separate ownership.

Do single-member LLCs pay quarterly taxes?

Yes. Due to the single-member paying self-employment taxes on the income being received, it’s required to pay the estimated tax throughout the year (April 15, June 15, September 15, and January 15). This can be completed by registering with the IRS through their Online Portal (EFPTS).

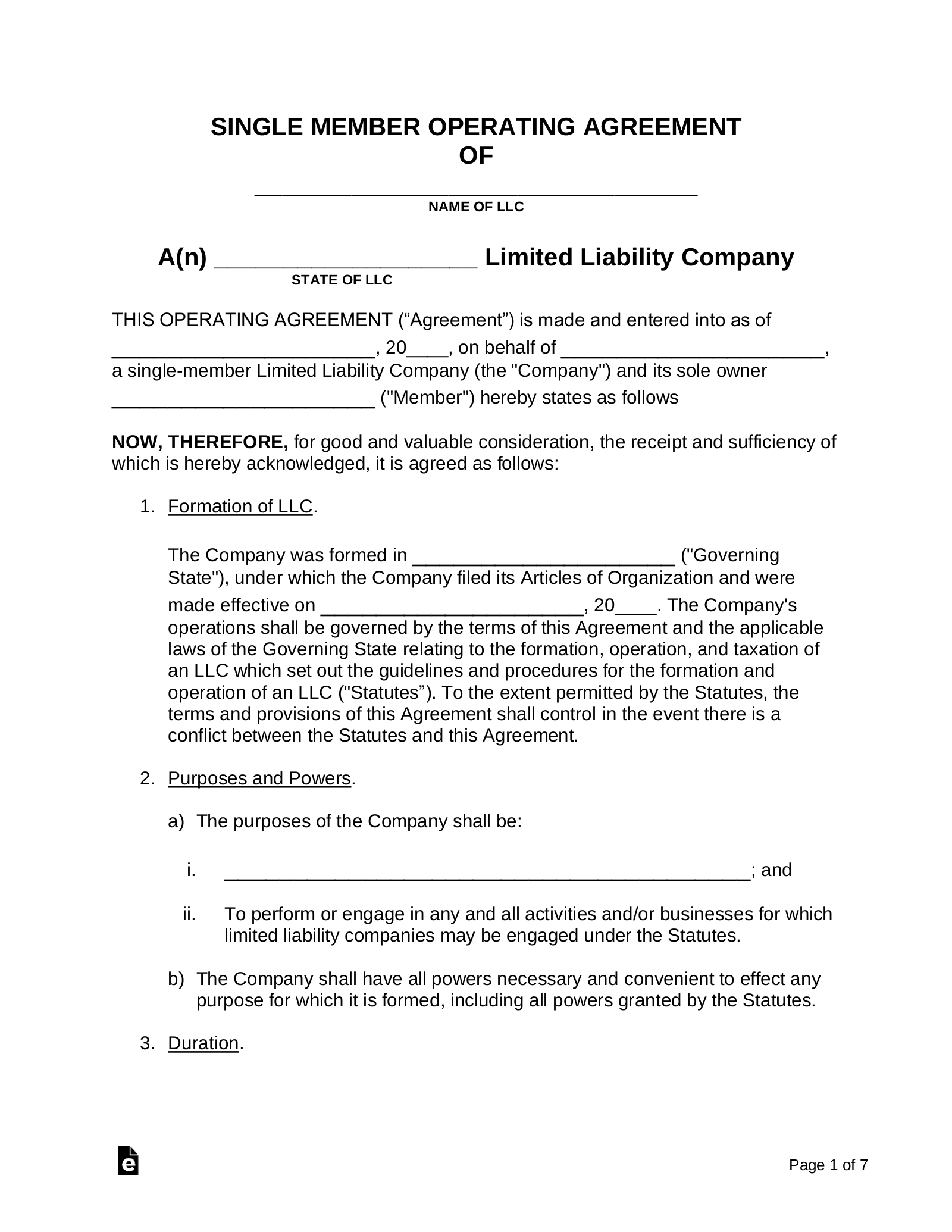

Sample

SINGLE MEMBER OPERATING AGREEMENT

OF

[NAME OF LLC]

A(n) [STATE] Limited Liability Company

THIS OPERATING AGREEMENT (“Agreement”) is made and entered into as of [DATE], on behalf of [NAME OF LLC], a single-member Limited Liability Company (the “Company”) and its sole owner [NAME OF MEMBER] (“Member”) hereby states as follows:

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, it is agreed as follows:

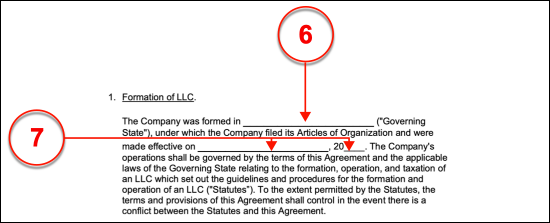

1. Formation of LLC.

The Company was formed in [STATE] (“Governing State”), under which the Company filed its Articles of Organization and were made effective on [DATE]. The Company’s operations shall be governed by the terms of this Agreement and the applicable laws of the Governing State relating to the formation, operation, and taxation of an LLC which set out the guidelines and procedures for the formation and operation of an LLC (“Statutes”). To the extent permitted by the Statutes, the terms and provisions of this Agreement shall control in the event there is a conflict between the Statutes and this Agreement.

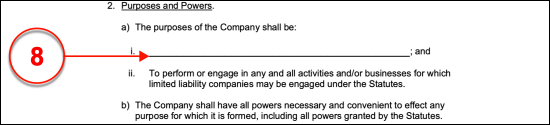

2. Purposes and Powers.

a.) The purposes of the Company shall be:

i.) [BUSINESS PURPOSE]; and

ii.) To perform or engage in any and all activities and/or businesses for which limited liability companies may be engaged under the Statutes.

b.) The Company shall have all powers necessary and convenient to effect any purpose for which it is formed, including all powers granted by the Statutes.

3. Duration.

The Company shall continue in existence until dissolved, liquidated, or terminated in accordance with the provisions of this Agreement and, to the extent not otherwise superseded by this Agreement, the Statutes.

4. Registered Office and Resident Agent.

The Registered Office and Resident Agent of the Company shall be as designated in the initial Articles of Organization/Certificate of Organization or any amendment thereof. The Registered Office and/or Resident Agent may be changed from time to time. Any such change shall be made in accordance with the Statutes, or, if different from the Statutes, in accordance with the provisions of this Agreement. If the Resident Agent ever resigns, the Company shall promptly appoint a successor agent.

5. Capital Contributions and Distributions.

The Member may make such capital contributions (each a “Capital Contribution”) in such amounts and at such times as the Member shall determine. The Member shall not be obligated to make any Capital Contributions. The Member may take distributions of the capital from time to time in accordance with the limitations imposed by the Statutes.

6. Books, Records, and Accounting.

a.) Books and Records. The Company shall maintain complete and accurate books and records of the Company’s business and affairs as required by the Statutes and such books and records shall be kept at the Company’s Registered Office and shall in all respects be independent of the books, records, and transactions of the Member.

b.) Fiscal Year; Accounting. The Company’s fiscal year shall be the calendar year with an ending month of December.

7. Member’s Capital Accounts.

A Capital Account for the Member shall be maintained by the Company. The Member’s Capital Account shall reflect the Member’s capital contributions and increases for any net income or gain of the Company. The Member’s Capital Account shall also reflect decreases for distributions made to the Member and the Member’s share of any losses and deductions of the Company.

8. U.S. Federal / State Income Tax Treatment.

The Member intends that the Company, as a single-member LLC, shall be taxed as a sole proprietorship in accordance with the provisions of the Internal Revenue Code. Any provisions herein that may cause the Company not to be taxed as a sole proprietorship shall be inoperative.

9. Rights, Powers, and Obligations of the Member.

a.) Authority. The Member is the sole member of the Company, has sole authority and power to act for or on behalf of the Company, to do any act that would be binding on the Company, or incur any expenditures on behalf of the Company.

b.) Liability to Third Parties. The Member shall not be liable for the debts, obligations, or liabilities of the Company, including under a judgment, decree, or order of a court.

c.) Rights, Powers, and Obligations of Manager.

The Company is organized as a “member-managed” limited liability company.

The Member is designated as the initial managing member.

d.) Ownership of Company Property.

The Company’s assets shall be deemed owned by the Company as an entity, and the Member shall have no ownership interest in such assets or any portion thereof. Title to any or all such Company assets may be held in the name of the Company, one or more nominees, or in “street name,” as the Member may determine.

3.) Other Activities.

Except as limited by the Statutes, the Member may engage in other business ventures of any nature, including, without limitation by specification, the ownership of another business similar to that operated by the Company. The Company shall not have any right or interest in any such independent ventures or in the income and profits derived therefrom.

10. Limitation of Liability; Indemnification.

a.) Limitation of Liability and Indemnification of Member.

i. The Member (including, for purposes of this Section, any estate, heir, personal representative, receiver, trustee, successor, assignee and/or transferee of the Member) shall not be liable, responsible or accountable, in damages or otherwise, to the Company or any other person for: (i) any act performed, or the omission to perform any act, within the scope of the power and authority conferred on the Member by this Agreement and/or by the Statutes except by reason of acts or omissions found by a court of competent jurisdiction upon entry of a final judgment rendered and un-appealable or not timely appealed (“Judicially Determined”) to constitute fraud, gross negligence, recklessness or intentional misconduct; (ii) the termination of the Company and this Agreement pursuant to the terms hereof; (iii) the performance by the Member of, or the omission by the Member to perform, any act which the Member reasonably believed to be consistent with the advice of attorneys, accountants or other professional advisers to the Company with respect to matters relating to the Company, including actions or omissions determined to constitute violations of law but which were not undertaken in bad faith; or (iv) the conduct of any person selected or engaged by the Member.

ii. The Company, its receivers, trustees, successors, assignees, and/or transferees shall indemnify, defend and hold the Member harmless from and against any and all liabilities, damages, losses, costs, and expenses of any nature whatsoever, known or unknown, liquidated or unliquidated, that are incurred by the Member (including amounts paid in satisfaction of judgments, in settlement of any action, suit, demand, investigation, claim or proceeding (“Claim”), as fines or penalties) and from and against all legal or other such costs as well as the expenses of investigating or defending against any Claim or threatened or anticipated Claim arising out of, connected with or relating to this Agreement, the Company or its business affairs in any way; provided, that the conduct of the Member which gave rise to the action against the Member is indemnifiable under the standards set forth in this section.

iii. Upon application, the Member shall be entitled to receive advances to cover the costs of defending or settling any Claim or any threatened or anticipated Claim against the Member that may be subject to indemnification hereunder upon receipt by the Company of any undertaking by or on behalf of the Member to repay such advances to the Company, without interest, if the Member is Judicially Determined not to be entitled to indemnification under this section.

iv. All rights of the Member to indemnification under this this section shall (i) be cumulative of, and in addition to, any right to which the Member may be entitled to by contract or as a matter of law or equity, and (ii) survive the dissolution, liquidation or termination of the Company as well as the death, removal, incompetency or insolvency of the Member.

v. The termination of any Claim or threatened Claim against the Member by judgment, order, settlement, or upon a plea of nolo contendere or its equivalent shall not, of itself, cause the Member not to be entitled to indemnification as provided herein unless and until Judicially Determined to not be so entitled.

11. Death, Disability, Dissolution.

a.) Death of Member. Upon the death of the Member, the Company shall be dissolved. By separate written documentation, the Member shall designate and appoint the individual who will wind down the Company’s business and transfer or distribute the Member’s Interests and Capital Account as designated by the Member or as may otherwise be required by law.

b.) Disability of Member. Upon the disability of a Member, the Member may continue to act as Manager hereunder or appoint a person to so serve until the Member’s Interests and Capital Account of the Member have been transferred or distributed.

c.) Dissolution. The Company shall dissolve and its affairs shall be wound up on the first to occur of:

i. At a time or upon the occurrence of an event specified in the Articles of Organization or this Agreement.

ii. The determination by the Member that the Company shall be dissolved.

12. Miscellaneous Provisions.

a.) Article Headings. The Article headings and numbers contained in this Agreement have been inserted only as a matter of convenience and for reference and in no way shall be construed to define, limit or describe the scope or intent of any provision of this Agreement.

b.) Entire Agreement. This Agreement constitutes the entire agreement between the Member and the Company. This Agreement supersedes any and all other agreements, either oral or written, between said parties with respect to the subject matter hereof.

c.) Severability. The invalidity or unenforceability of any particular provision of this Agreement shall not affect the other provisions hereof, and this Agreement shall be construed in all respects as if such invalid or unenforceable provisions were omitted.

d.) Amendment. This Agreement may be amended or revoked at any time by a written document executed by the Member.

e.) Binding Effect. Subject to the provisions of this Agreement relating to transferability, this Agreement will be binding upon and shall inure to the benefit of the parties, and their respective distributees, heirs, successors, and assigns.

f.) Governing Law. This Agreement is being executed and delivered in the Governing State and shall be governed by, construed, and enforced in accordance with the laws of the Governing State.

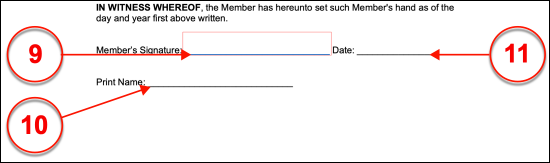

IN WITNESS WHEREOF, the Member has hereunto set such Member’s hand as of the day and year first above written.

Member’s Signature: ____________________________ Date: _______________

Print Name: ____________________________

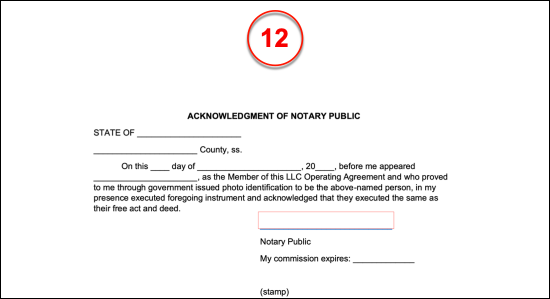

ACKNOWLEDGMENT OF NOTARY PUBLIC

STATE OF ______________________

______________________ County, ss.

On this ____ day of ______________________, 20____, before me appeared ______________________, as the Member of this LLC Operating Agreement and who proved to me through government issued photo identification to be the above-named person, in my presence executed foregoing instrument and acknowledged that they executed the same as their free act and deed.

____________________________

Notary Public

My commission expires: _____________

(stamp)

How to Write

Download: PDF, Microsoft Word (.docx), Open Document Text (.odt)

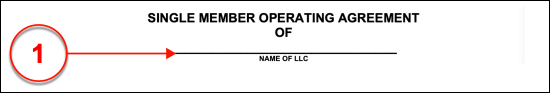

Title Introduction

(1) Name Of LLC. This paperwork must clearly introduce itself to any Reviewers at first glance as a specific agreement with the concerned Single Member Limited Liability Company. Therefore the title of this document expects a production of the legal name of the Single Member Limited Liability Company whose structure will be discussed. Review this Entity’s articles of organization then transcribe its full name to the “Name Of LLC” line in the title.

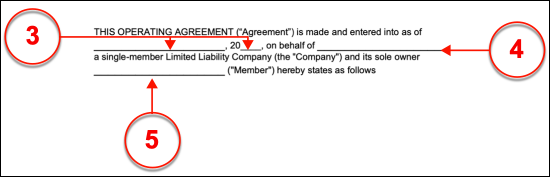

(2) State Of LLC. The State where the Single Member Limited Liability Company filed its articles of organization must be identified. Produce the name of this State on the line labeled “State Of LLC.”

(3) Operating Agreement Effective Date. The current document must have a predetermined date of effect. This will be the calendar date marking the day when the Single Member and the Limited Liability Company begin the working relationship that will be defined. This date may not be before the signature date of the Single Member or the date of the concerned Entity’s formation.

(4) Limited Liability Company Name. The introduction to this agreement requires some additional information produced to complete its language. Supply the full name of the Single Member Limited Liability Company on the first line following the reported date of this agreement.

(5) Owner As Single Member. The Limited Liability Company Member who shall sign this agreement as its Single Member must be named in the last available space of the introduction. Only the full legal name of the Party who shall sign this agreement as the Single Member of the Limited Liability Company should be presented in this space.

I. Formation Of LLC

(6) Governing State. The First Article of this agreement must make a statement regarding how the Limited Liability Company was formed. The name of the “Governing State” where it was created through its articles of organization should be documented in the appropriately labeled area of this statement

(7) Articles Of Organization Report. The precise date when the articles of organization of the Limited Liability Company were approved and made active by the State where they were submitted must be furnished to the second area of this statement.

II. Purposes And Powers

(8) LLC Purpose. The reason for forming the LLC as defined in its articles of organization must be documented in Article II. Seek the blank line available in Statement (A), then define why the Limited Liability Company was formed by recording this purpose. It is strongly recommended that the purpose documented in the Limited Liability Company’s articles or organization be transcribed to this area.

Formal Execution Of Document

(9) Member’s Signature. The Single Member who will enter the above agreement with the defined Limited Liability Company as its only Member must sign his or her name to do so.

(10) Print Name. The full name of the Single Member who has signed this paperwork must be supplied to the area below his or her signature.

(11) Date. Once the Single Member has completed the act of signing and printed his or her name, the current date must be documented. Since it can be potentially crucial to be able to verify the Single Member signed this paperwork upon a certain date, it is strongly recommended that the signature process is subjected to notarization when it occurs, regardless of the requirements of the State that governs the Single Member Limited Liability Company’s behavior.

(12) Single Member Signature Notarization. The final area may not be completed by any Party other than a licensed Notary Public who has verified the Single Member’s identity and has subjected the signing to notarization. He or she shall complete the “Notarization” section as proof that this process was completed.

Related Forms

LLC Operating Agreement Amendment

LLC Operating Agreement Amendment

Download: PDF, MS Word, OpenDocument

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Download: PDF, MS Word, OpenDocument