Updated August 23, 2023

A commercial real estate purchase agreement is a legal document between a buyer seeking to purchase commercial property from a seller for an agreed-upon price. It is commonly written as an offer by a buyer with the agreement being legally binding after signature and acceptance by the seller.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

What is a Commercial Purchase Agreement?

A commercial purchase agreement allows a seller to transact a deal with an eligible buyer to transfer ownership of their real estate in exchange for cash or other trade. The buyer will commonly be required to deposit earnest money, known as “consideration”, in order for the contract to be valid.

The earnest money is usually between 2% to 5% of the purchase price and is refundable only if there are problems found with the property during an inspection or while performing other due diligence.

Common Types of Commercial Property (6)

- Apartments (more than 4 units)

- Hotel

- Industrial

- Office

- Land

- Retail (shop, restaurant, etc.)

Video

How to Buy Commercial Property (6 steps)

- Requirements for Buyer

- Finding Property Listed for Sale

- Getting Pre-Approved for Financing

- Negotiating with the Seller

- The Closing

- Filing the Deed

As the buyer, the art of purchasing commercial property is about finding the investment that suits your needs. The purchase price is usually a reflection of the current market conditions and the revenue it’s generating if there are tenants on the property.

1. Requirements for Buyer

It is imperative that the buyer checks their personal credit, and if an entity is purchasing, the credit profile of the business. This will determine initially if the buyer is confident they should be able to get financing from a traditional lender.

For traditional transactions, the requirements are:

- Good credit (680+); and

- 20% to 25% of the purchase price as the downpayment.

Check Your Credit (free)

- Your Credit Card – Most credit card companies offer their clients to view their credit report for free.

- CreditKarma – Best website to check someone’s personal credit score.

- Dun & Bradstreet – Best website to check a business’s credit score (1 per email).

2. Finding Property Listed for Sale

No matter if the buyer is looking with a real estate broker or without, the seller traditionally pays the brokerage fee. Therefore, it’s in the best interest of the buyer to hire an agent that has experience in the industry and will have a fiduciary duty to act in the buyer’s best interest.

Use the following websites to find properties for sale:

- LoopNet.com (site not accessible outside the USA)

- RealtyTrac.com

- PropertyShark.com

- CoStarGroup.com (site not accessible outside the USA)

3. Getting Pre-Approved for Financing

Getting pre-approved for financing is required before most sellers will begin negotiations for the purchase of a property. Depending on the seller, a pre-qualification letter or pre-approval letter will suffice.

Pre-Qualification Letter

Non-binding letter from a financial institution stating the buyer’s overall creditworthiness. The letter will give a financial overview including income, investments, debts, and any other assets or liabilities. This is a quick snapshot of the owner’s financial capability and not a letter certifying a loan.

Pre-Approval Letter

Binding letter from a financial institution that states the credibility of the buyer by mentioning the maximum approved loan amount, interest rate, and downpayment percentage. There is often an extensive overview of the individual’s and/or business’s credit which may involve other records of the buyer such as tax statements, verification of income, investment certificates, and any other financial authentication.

4. Negotiating with the Seller

When the buyer finds a property that matches their business or investment strategy, it’s time to begin negotiations with the owner. It’s best to approach the owner at a price that matches the current market conditions while at the same time not being an insultingly low offer.

Earnest Money Deposit

An earnest money deposit is commonly in the form of a check that is attached to a purchase agreement that symbolizes the buyer’s seriousness in purchasing the property. The earnest money will commonly be equal to 1% to 5% of the purchase price and is only refundable depending on any contingencies in the agreement.

Adding Contingencies

A contingency says, “This contract will become void if [ENTER CONTINGENCY],” which usually is contingent on the buyer getting financing, that the property is in good condition, and any other due diligence by the buyer. If the property does not complete due to a contingency, the agreement is terminated, and the earnest money is returned to the buyer.

Common Types (6)

- Financing Contingency – Simple clause in the agreement that states if the buyer, for any reason, is not able to get financing, the purchase agreement is void.

- Inspection Contingency – The agreement remains valid, barring any new liabilities found in the structure of the property, such as the roof, foundation, electrical, plumbing, or any other repairs needed.

- Environmental Contingency – More common for retail properties, soil, and environmental testing will need to be completed (known as a “Phase 1 Environmental Assessment”).

- Zoning Contingency – If the buyer needs permitting before purchasing the property. For example, the buyer needs to get approval to put a restaurant on the property before it can purchase. The buyer may enter any contingency to accommodate their needs with the consent of the seller.

- Environmental Contingency – More common for retail properties, soil, and environmental testing will need to be completed (known as a “Phase 1 Environmental Assessment”).

5. The Closing

The closing is when the parties meet and the financial transaction is completed. This is commonly done at a lawyer’s office or title company that handles the required documents and verifies the funds have been sent and received while administering the new deed. If there are any real estate agents, they will be owed their commission as written in their listing agreement.

After the closing, the seller will have been paid-in-full, with the buyer receiving the title that will be filed by the buyer or handed off to their attorney to be filed with the Registry of Deeds.

6. Filing the Deed

If the property is in a registered county, there should be a recorder or registry of deeds office where all the local property records are located. If you choose to file the deed there may be a transfer or sales tax (should have been administered during the closing) along with the buyer being required to sign the deed in the presence of a notary. After the deed has been filed and accepted the property is in the name of the buyer.

What is a 1031 Exchange?

A 1031 exchange specifically refers to the Internal Revenue Code (IRC) Section 1031 that allows an owner of real estate to sell their property and not pay any tax if they purchase a “like-kind” property after the closing.

What does “Like-Kind” mean?

According to IRC 1.1031(a)-1(b) “like-kind” is more of the “nature” and “character” of the property than its grade or quality. For example, if the property sold is a 4-unit apartment building then most likely under a 1031 exchange the seller will be required to buy residential housing. The two (2) properties must have generic similarities.

Required Time Periods (After the Closing Date)

- 45 Days – The seller must identify the property they want to purchase.

- 180 Days – The seller must have completed the purchase of the property.

IRS Definition

Section 1031(a)(1) provides an exception from the general rule requiring the recognition of gain or loss upon the sale or exchange of property. Under section 1031(a)(1), no gain or loss is recognized if property held for productive use in a trade or business or for investment is exchanged solely for property of a like kind to be held either for productive use in a trade or business or for investment. Under section 1031(a)(1), property held for productive use in a trade or business may be exchanged for property held for investment. Similarly, under section 1031(a)(1), property held for investment may be exchanged for property held for productive use in a trade or business.

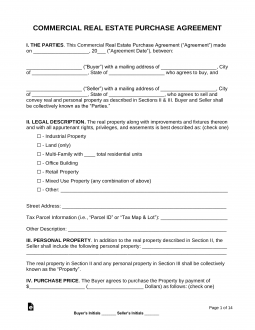

Samples

Use the samples below that are modified agreements from online resources such as State real estate commissions and agency websites.

Sample 1

Download: PDF

Sample 2

Download: PDF

Sample 3

Download: PDF