Updated September 08, 2023

A land purchase contract is between a buyer who agrees to buy unimproved (raw) land from its owner (seller). It includes a purchase price, earnest money deposit, closing date, and other negotiated terms by the parties. The buyer will commonly add a contingency (due diligence period) to allow for soil testing, especially for commercial property. A Phase I or Phase II environmental test can take anywhere from 60-120 days to perform.

Earnest Money Deposit: Also known as “consideration,” earnest money is paid by the buyer at the signing of a land contract and acts as a good-faith deposit toward the purchase.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

What is a Land Contract?

A land contract is a document that establishes the terms and conditions for the purchasing of vacant land for cash or trade. A land contract, similar to a standard purchase and sale agreement, details the agreement between the buyer and seller, including conditions, contingencies, and due diligence periods.

Installment Land Contract

An installment land contract is when a buyer makes partial payments, each month, after the closing to pay the full sales price. Also referred to as “owner financing,” it allows a seller to act as the bank and collect principal plus interest payments from the buyer. Even though the buyer will own the property after the closing, the seller will be a lienholder with the right to repossess the property if payment is not made.

Land Contract Calculators

- Calculator #1 – www.premier-title.net

- Calculator #2 – www.landfs.com

- Calculator #3 – www.easycalculation.com

How a Land Contract Works (5 steps)

- Make an Offer

- Wait to Hear from the Seller

- Due Diligence Period

- Closing on the Property

- Recording the Deed

1. Make an Offer

In order to make an offer for purchase, the buyer will need to complete the land contract on their own or with the assistance of a real estate agent or attorney. The buyer will need to enter all the information about the land, which can be obtained from the local assessor’s office, and list any conditions for the sale.

In order to make an offer for purchase, the buyer will need to complete the land contract on their own or with the assistance of a real estate agent or attorney. The buyer will need to enter all the information about the land, which can be obtained from the local assessor’s office, and list any conditions for the sale.

2. Wait to Hear from the Seller

After the contract has been finalized by the buyer, the seller will need to either reject, counter-offer, or accept the terms of the agreement. If accepted, the buyer must pay the earnest money deposit (use the Earnest Money Deposit Receipt) and begin their due diligence period.

After the contract has been finalized by the buyer, the seller will need to either reject, counter-offer, or accept the terms of the agreement. If accepted, the buyer must pay the earnest money deposit (use the Earnest Money Deposit Receipt) and begin their due diligence period.

3. Due Diligence Period

In most agreements, there is a due diligence period that allows the buyer to conduct tests on the property to ensure it can be used for the buyer’s intentions.

In most agreements, there is a due diligence period that allows the buyer to conduct tests on the property to ensure it can be used for the buyer’s intentions.

This may include conducting environmental tests (Phase I, Phase II, etc.), obtaining permits from the local government, or any other contingencies mentioned in the agreement.

4. Closing on the Property

After the due diligence on the property has concluded and contingencies have been waived, it’s time to prepare for the closing. If the buyer is seeking to pay cash, then the closing can occur almost immediately. If the buyer has decided to obtain financing, then most lenders will require an environmental report (i.e. Phase I) and have the property appraised by a third party.

After the due diligence on the property has concluded and contingencies have been waived, it’s time to prepare for the closing. If the buyer is seeking to pay cash, then the closing can occur almost immediately. If the buyer has decided to obtain financing, then most lenders will require an environmental report (i.e. Phase I) and have the property appraised by a third party.

After the buyer has completed the necessary steps to obtain funds to purchase, the parties may schedule a closing date.

5. Recording the Deed

At the closing, the seller will verify the funds have been received and sign over the deed to the property to the buyer. The deed acts as the title to the property proving the buyer’s ownership. It is required for the deed to be filed with the Registry of Deeds in the county where the property is located.

At the closing, the seller will verify the funds have been received and sign over the deed to the property to the buyer. The deed acts as the title to the property proving the buyer’s ownership. It is required for the deed to be filed with the Registry of Deeds in the county where the property is located.

There is usually a tax on property sales calculated on what is known as a “mill rate” for each jurisdiction. Unless otherwise agreed upon, this tax is usually split between the buyer and seller.

Frequently Asked Questions

Does a land contract have to be recorded?

Yes and no. The contract itself does not have to be recorded. However, after the closing has taken place, the transfer of ownership must be recorded through a deed.

Is it possible to sell a land contract?

Yes, as long as the contract has the right to assign the agreement to someone else.

Is it possible to rent land?

Yes, but this is more common in commercial property transactions than residential.

Is there a difference between a residential and commercial land contract?

No, both contracts are the same unless due to local or state laws.

Sample

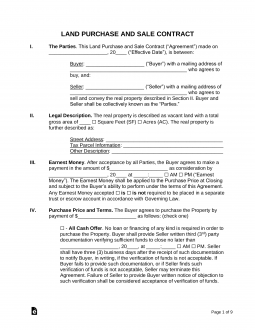

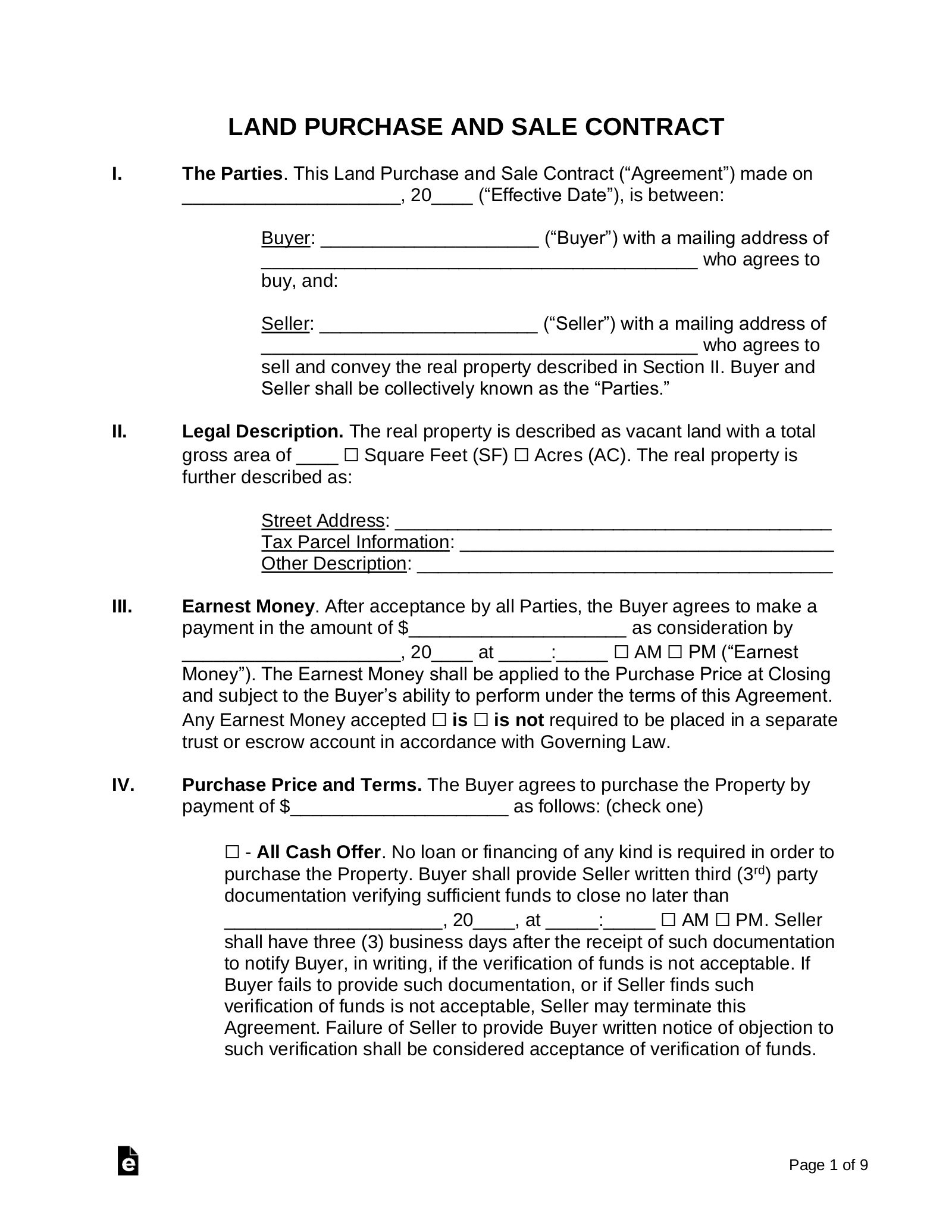

LAND PURCHASE AND SALE CONTRACT

I. The Parties. This Land Purchase and Sale Contract (“Agreement”) made on [DATE] (“Effective Date”), is between:

Buyer: [BUYER’S NAME] (“Buyer”) with a mailing address of [ADDRESS] who agrees to buy, and:

Seller: [SELLER’S NAME] (“Seller”) with a mailing address of [ADDRESS] who agrees to sell and convey the real property described in Section II. Buyer and Seller shall be collectively known as the “Parties.”

II. Legal Description. The real property is described as vacant land with a total gross area of [#] ☐ Square Feet (SF) ☐ Acres (AC). The real property is further described as:

Street Address: [ADDRESS]

Tax Parcel Information: [LEGAL DESCRIPTION]

Other Description: [OTHER]

III. Earnest Money. After acceptance by all Parties, the Buyer agrees to make a payment in the amount of $[AMOUNT] as consideration by [DATE], at [TIME] ☐ AM ☐ PM (“Earnest Money”). The Earnest Money shall be applied to the Purchase Price at Closing and subject to the Buyer’s ability to perform under the terms of this Agreement. Any Earnest Money accepted ☐ is ☐ is not required to be placed in a separate trust or escrow account in accordance with State law.

IV. Purchase Price and Terms. The Buyer agrees to purchase the Property by payment of $[AMOUNT] that is: (check one)

☐ – Not Subject to Financing. No loan or financing of any kind is required in order to purchase the Property.

☐ – Subject to Financing. A loan or a form of financing is required in order to purchase the Property. The Seller recognizes that the Buyer’s ability to purchase the Property is contingent upon the Buyer’s ability to obtain a: (check one)

☐ – Conventional Mortgage

☐ – FHA Loan

☐ – VA Loan (Attach Required Addendums)

☐ – Seller Financing

V. Sale of Another Property. Buyer’s performance under this Agreement: (check one)

☐ – Shall not be contingent upon selling another property.

☐ – Shall be contingent upon selling another property with a mailing address of [ADDRESS] within [#] days from the Effective Date.

VI. Closing Costs. The costs attributed to the Closing of the Property shall be the responsibility of ☐ Buyer ☐ Seller ☐ Both Parties.

VII. Closing. This transaction shall be closed on [DATE], at [TIME] ☐ AM ☐ PM or earlier at the office of a title company to be agreed upon by the Parties (“Closing”).

VIII. Survey. The Buyer may obtain a survey of the Property before the Closing to assure that there are no issues (“Survey Problems”). The cost of the survey shall be paid by the Buyer. Not later than [#] business days prior to the Closing, Buyer shall notify Seller of any Survey Problems which shall be deemed to be a defect in the title to the Property. Seller shall be required to remedy such defects within [#] business days and prior to the Closing.

If Seller does not or cannot remedy any such defect(s), Buyer shall have the option of canceling this Agreement, in which case the Earnest Money shall be returned to Buyer.

IX. Title. Upon receipt of the Title Search Report, the Buyer shall have [#] business days to notify the Seller, in writing, of any matters disclosed in the report which are unacceptable to the Buyer. The Buyer’s failure to timely object to the report shall constitute acceptance of the Title Search Report.

If any objections are made by the Buyer regarding the Title Search Report, mortgage loan inspection, or other information that discloses a material defect, the Seller shall have [#] business days from the date the objections were received to correct said matters. If Seller does not remedy any defect discovered by the Title Search Report, Buyer shall have the option of canceling this Agreement, in which case the Earnest Money shall be returned to Buyer.

X. Property Condition. Seller agrees to maintain the Property in its current condition, subject to ordinary wear and tear, from the time this Agreement comes into effect until the Closing. Buyer recognizes that the Seller, along with any licensed real estate agent(s) involved in this transaction, make no claims as to the validity of any property disclosure information. Buyer is required to perform their own inspections, tests, and investigations to verify any information provided by the Seller. Afterward, the Buyer shall submit copies of all tests and reports to the Seller at no cost.

Therefore, the Buyer shall hold the right to hire licensed contractors, or other qualified professionals, to further inspect and investigate the Property until [DATE], at [TIME] ☐ AM ☐ PM.

After all inspections are completed, the Buyer shall have until [DATE], at [TIME] ☐ AM ☐ PM to present any new property disclosures to the Seller in writing. The Buyer and Seller shall have [#] business days to reach an agreement over any new property disclosures found by the Buyer. If the Parties cannot come to an agreement, this Agreement shall be terminated with the Earnest Money being returned to the Buyer.

XI. Appraisal. Buyer’s performance under this Agreement: (check one)

☐ – Shall not be contingent upon the appraisal of the Property being equal to or greater than the agreed upon Purchase Price.

☐ – Shall be contingent upon the appraisal of the Property being equal to or greater than the agreed upon Purchase Price. If the Property does not appraise to at least the amount of the Purchase Price, or if the appraisal discovers lender-required repairs, the Parties shall have [#] business days to re-negotiate this Agreement (“Negotiation Period”). In such event the Parties cannot come to an agreement during the Negotiation Period, this Agreement shall terminate with the Earnest Money being returned to the Buyer.

XII. Termination. In the event this Agreement is terminated, as provided in this Agreement, absent of default, any Earnest Money shall be returned to the Buyer, in-full, within [#] business days with all parties being relieved of their obligations as set forth herein.

XIII. Governing Law. This Agreement shall be interpreted in accordance with the laws in the state of [STATE].

XIV. Severability. In the event any provision or part of this Agreement is found to be invalid or unenforceable, only that particular provision or part so found, and not the entire Agreement, will be inoperative.

XV. Offer Expiration. This offer to purchase the Property as outlined in this Agreement shall be deemed revoked and the Earnest Money shall be returned unless this Agreement is signed by Seller and a copy of this Agreement is personally given to the Buyer by [DATE], at [TIME] ☐ AM ☐ PM

XVI. Licensed Real Estate Agent(s). If Buyer or Seller has hired the services of licensed real estate agent(s) to perform representation on their behalf, he/she/they shall be entitled to payment for their services as outlined in their separate written agreement.

XVII. Disclosures. It is acknowledged by the Parties that: (check one)

☐ – There are no attached addendums to this Agreement.

☐ – The following addendums are attached to this Agreement:

☐ – Lead-Based Paint Disclosure Form

☐ – [TITLE OF DOCUMENT]

☐ – [TITLE OF DOCUMENT]

XVIII. Additional Terms and Conditions. [ADDITIONAL TERMS]

IN WITNESS WHEREOF, the Buyer and Seller have executed this Agreement as of the day and year first above written.

Buyer’s Signature: ________________________ Date: ______________

Print: ________________________

Buyer’s Signature: ________________________ Date: ______________

Print: ________________________

Seller’s Signature: ________________________ Date: ______________

Print: ________________________

Seller’s Signature: ________________________ Date: ______________

Print: ________________________

For the comprehensive document, please download the free form or hit “create document.”