Updated April 16, 2024

A general warranty deed, or “statutory warranty deed,” is a document that transfers the ownership of real estate with a guarantee in the title, vested in fee simple to the ownership of the property along with all past owners. When a conveyance of land takes place, the new owner is listed as the last known holder of the title, along with a list of all past owners, including their names, purchase price, mortgages (if any), and the sale dates. This type of deed transfers the property in the cleanest way possible to guarantee ownership.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

What is a Warranty Deed?

If you plan on buying a home for yourself or a commercial property for your business in the near future, then you will need to know about a warranty deed. It’s the most buyer-friendly legal document available when it comes to the transferring of real property. As the name states, this type of deed provides the buyer (or grantee) a “warranty” that the seller (or grantor) has the authority to give you interest and ownership of the property.

Warranty deeds offer insurance that you will have ownership of the property before making the final sale. It is the most common deed used in the transaction of real estate.

How to Use a Warranty Deed

Most instances of transferring or the selling/buying of real estate involve two strangers that have never met before. One (the grantor) is interested in selling the property, and the other (the grantee) is interested in buying it.

Warranty deeds are used to give the grantee protections against potential fraud and financial burdens that may come with the property—especially if the grantor does not have the authority to sell it! The deed stipulates the terms of the sale, in what county the sale takes place, the legal description of the property and its boundaries, the two parties involved in the transfer, and any covenants made to the new owner and past owners of the property. It is a document you will want to see and sign before closing the deal on your new property.

If you receive a warranty deed with someone, you as the buyer will have these guarantees:

- The property has not already been sold to someone else

- The seller (grantor) is the owner and can legally sell the property

- If there are multiple owners of the property, then the exact claim or portion of the seller’s interest is stipulated clearly and given to the buyer after the transaction

- Any claim by an unknown party for rights to ownership and title of the property will be dealt with and (in case of loss) reimbursed by the seller

- Any debt or other outstanding or unspecified encumbrances are covered by the seller and not the buyer

- The property matches the legal description and address of the property in the deed

All of these assurances need to be stipulated in writing. This will assure the buyer and let them know they are paying what they agreed to buy. However, there are two versions of the warranty deed that you as the buyer need to know about. Each of them slightly changes the stipulations on the warranties provided in the deed.

General Warranty Deed vs. Special Warranty Deed

In the world of warranty deeds, there are two types out there you should know the difference between—general warranty deeds and special warranty deeds. Both provide the same “warranties” that make them a necessity for buyers, but each sets slightly different standards as to the extent that these warranties cover.

The general warranty deed is the all-around insurance package that provides the consumer with the highest degree of protection in the face of fraud, issues with the property, or claims to interest/title to the real estate (as stated in the deed). With the general warranty deed, the grantor will hold full responsibility for any legal cases made against the property and any problems with it. This extends to the full history of the property, even any issues that arise from before the seller (grantor) owned the property. Any and all covenants fall on the seller’s shoulders.

On the other hand, special warranty deeds offer slightly fewer protections for the buyer than the general warranty deed. This document provides some level of protection for both the buyer and the seller. Special warranties do this by only holding the grantor responsible for any covenants and issues with the property that came from when they owned the property. It does not extend to the entire history of the property like general warranty deeds, leaving the grantee stuck with any legal claims, debts, or covenants that were established before the period of the last owner.

So if given a choice between which warranty you would want to receive, it’s your best bet to use a general warranty for the most buyer protection. Special warranty deeds are not all bad though, and they offer at least the general insurance that you as the buyer want to have when buying any kind of real estate.

Warranty Deed Laws

- AL – § 35-4-271

- AK – AS 34.15.030

- AZ – § 33-402

- AR – § 18-12-102

- CA – § 1092

- CO – § 38-30-113

- CT – Sections 47-36c & 47-36d

- DE – § 121

- FL – § 689.02

- GA – § 44-5-62

- HI – Chapter 13-16

- ID – § 55-612

- IL – 765 ILCS 5/9

- IN – § 32-17-1-2

- IA – § 558.19(3)

- KS – § 58-2203

- KY – KRS 382.030

- LA – CC 2475

- ME – Title 33, § 763

- MD – § 2-105

- MA – Chapter 183, Section 10

- MI – § 565.151

- MN – § 507.07

- MS – § 89-1-33

- MO – § 442.430

- MT – § 70-20-103

- NE – § 76-206

- NV – NRS 111.312

- NH – § 477:27

- NJ – Section 46:4-7

- NM – (§ 47-1-29 & § 47-1-44)

- NY – NY Real Prop L § 258

- NC – § 47H-6

- ND – § 47-10-13

- OH – § 5302.05

- OK – § 16-40

- OR – ORS 93.850

- PA – 21 P.S. § 5

- RI – § 34-11-12

- SC – § 27-7-10

- SD – § 43-25-5

- TN – § 66-5-103

- TX – § 66-5-103

- UT – § 57-1-12

- VT – § 301

- VA – § 55-68

- WA – RCW 64.04.030

- WV – § 36-4-2

- WI – § 706.10(5)

- WY – § 34-2-102

Other Types of Deeds

Quit Claim Deed – When the current owner on record can only transfer their interest in a property. It does not guarantee that the current owner owns the property and provides no other guarantees to any prior owner’s claims. This type of deed comes along with the highest risk to the Grantee (new owner).

Special Warranty Deed – This type only guarantees the rights to the title during the time span of the selling party. This type of deed does not guarantee the title for any prior owners of the land other than the seller.

Transfer on Death Deed – This document transfers the ownership of a person’s real estate after that person dies. The person transferring ownership, or grantor, must specify a beneficiary before death. While this method of transferring property circumvents the probate process, making it simpler and quicker than using a will, it is only legally valid in some states.

Will vs. TODDs

The effect of a transfer on death deed is similar to that of a last will and testament but saves costs. Property in a will must go through probate, which can be lengthy and expensive: In California, for example, an estate worth $600,000 would face representative and attorney fees of $30,000. Property passed through a TODD avoids probate, and the beneficiary takes ownership of the property, usually when the death certificate is recorded.

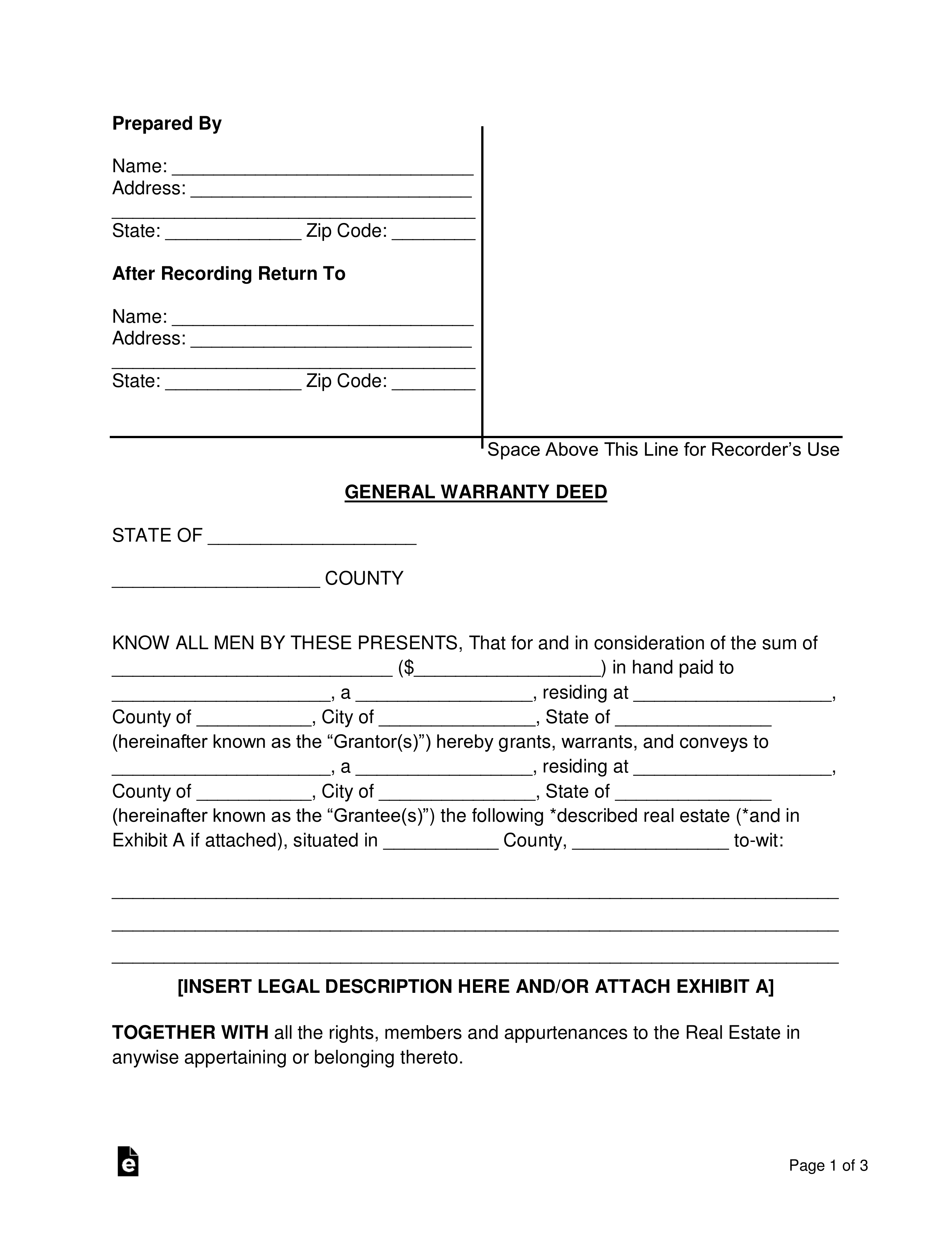

How to Write

1 – Download The Warranty Form In The Preferred Format

The General Warranty Deed Form is accessible directly from this page. Choose the document or file type you prefer to work with from the buttons on the right. When you are ready, select one of the buttons to obtain a PDF, OTD, or Word file. You may work on this form directly onscreen with the appropriate browser or editing program or simply print it then fill it out

2 – Supply The Preparer’s Information

The upper right-hand corner of this form will have the heading “Prepared By.” Generally, this document is prepared by the individual granting the property through this deed however, any party may prepare and submit this document on the Grantor’s behalf as well (provided the Grantor agrees with and signs this form).

The first piece of information requested will be the blank space labeled “Name.” The Full Name of the Preparer must be presented in this space. Below this will be two empty lines where the Preparer’s Address must be displayed. Finally, the State and Zip Code of the Preparer’s Address must be reported in their proper areas

3 – Define Future Recipients

Once this document has been issued and recorded, there may be some question as to where official correspondence from concerned government agencies may be sent. This information should be disclosed in the “After Recording Return To” section.

As with the previous section, there will be three lines that require attention. On the first line, report the Name of the Mail Recipient. Then, using the two empty lines below this, report the Mailing Address. Finally, the third line will require the State and Zip Code, for the documented Mailing Address, supplied in their respective spaces

4 – Supply The Requested Information

Locate the heading “General Warranty Deed.” The initial area of this form will display the general language required for this form however, you must supply information unique to the parties involved and the Deed.

Enter the State where the Property is located on the first blank line this section, then report the County where the Property is located on the second blank line.

Find the first two blank spaces in the paragraph introduced by the term “Know all men…” These two spaces will require the Dollar Sum the Grantor has been paid to issue this document. It must be presented in two forms: written out and, in the parentheses, numerically. Supply this information using these areas.![]()

Next, following the term “…in hand paid to,” the Full Name of the Grantor should be presented in the available area. The space immediately following this requires the role or status of the Grantor (i.e. wife, accountant, retiree) supplied. The last blank space on this line, after “…residing at,” must have the Grantor’s Residential Address entered.![]()

The next line, beginning with “County of” will contain three blank spaces. In this order, report County, City, and State where the Grantor’s Residential Address is located.![]()

Locate the line after the words “…and coveys to.” This line will have three blank spaces requiring attention to define the individual (Grantee) receiving this Property. Utilize these areas to display the Grantee’s Full Name, the role or status of the Grantee, and the Residential Address of the Grantee (in that order).![]()

The final area of this paragraph begins with the words “Exhibit A…” Here, you must supply the County and the State, where the Property being granted through this deed is located, using the two blank spaces provided on this line. Below this statement will be several blank lines where the Legal Description of the Property being granted must be provided. If there is not enough room, you may include the Legal Description as an Attachment that is properly labeled, signed, and dated.![]()

5 – Required Grantor Signature

The Grantor should read the statements on the second page. Below this, ample space for two Grantors to provide their Signatures will be available. This section must be signed by at least one Grantor. Such Signatures should take place before two Witnesses, and a Notary Public.

Each Grantor will need to Sign his or her Name on the line labeled “Grantor Signature.” Below this, the Grantor’s Printed Name must be presented. The Grantor’s Address must also be reported and this may be done using the last two blank lines of his or her Signature area (“Address” and “City, State, & Zip”)

Locate the heading “In Witness Whereof.” Here, there will be enough room for two Witnesses to provide their Signatures. Each Witness must Sign and Print his or her Name as well as provide his or her Address.

The last page of this document has been reserved for the Notary Public who will notarize this form. Only he or she may fill out this area by supplying such facts as the Location, Signature Parties, and Date. Once, these items have been supplied by the Notary, he or she will then supply the required credentials and notarization seal for this document to be complete.

Where to Record?

Once the form has been completed and executed under state law, it must be recorded at the Registry of Deeds (or other County/Town office). See the table below for each state’s location and the laws that govern the recording of deeds.