Updated April 04, 2024

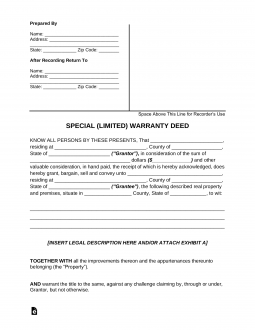

A special (limited) warranty deed transfers title in fee simple from the seller (“grantor”) to the purchaser (“grantee”) with a warranty of title limited to solely the acts of the grantor. In other words, this type of deed warrants only against events that transpired during the grantor’s time of ownership as opposed to throughout the title’s history and prior ownerships. Special deeds are typically used in commercial property transactions, but usage varies.

Required Statement / Granting Clause

“conveys and warrants specially”

For instance: “Tom Jones conveys and warrants specially unto Christina Kirschner the property located at 1 Forest-Wake Ave…”

(Note that clauses granting limited warranties can vary from state to state and may contain different language.)

Signing Requirements

Special warranty deeds must be signed with a notary public and/or witnesses (see table for more details).

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents

- Special Warranty Deeds: By State

- When to Use?

- How to File (4 steps)

- Definitions (Glossary)

- (Video) What is a Special Warranty Deed?

- How to Write

- Where to Record?

How to File a Special Warranty Deed (4 Steps)

- Negotiate with the Owner

- Gather the Required Information

- Authorizing the Form

- File/Recording the Deed

2. Gather the Required Information

Creating and recording the deed may seem daunting. However, through prior research, the parties can obtain the necessary information and move forward with confidence. The following details are crucial to know before executing the transfer and heading to the registry:

- Preparer’s By – If the grantor cannot fill out their own form, they should find an individual to assist with writing the form.

- Where to Mail After Recording – Obtain the address to send the deed after it is filed, typically the grantee’s address.

- Grantor’s and Grantee’s Information – Obtain the exact full names and mailing addresses of both parties.

- Consideration – Figure out the set purchase price in dollars and other considerations per the agreement.

Legal Description – Finally, and most importantly, obtain the “Deed Book and Page Numbers” from the County or City Recorder’s Office. A majority of states (if not all) require this description. It is also recommended, and in certain states required (e.g., Florida), to have the “Tax Map & Lot or Parcel ID” provided by the county or city assessor’s office included in the description.

3. Authorizing the Form

The deed will need to be executed in accordance with the State Signing Requirements. This usually consists of either two (2) witnesses and/or a notary public. Both Grantor and Grantee will be required to appear in front of the witnessing party, either physically or through an online presence, if allowed.

4. File/Recording the Deed

Every jurisdiction in the United States has a recording office dedicated to this very recordkeeping. The filing party, usually the grantor, should be sure to take a blank check to cover any filing fees set by the recorders’ offices.

Definitions

Consideration – Purchase Price.

Grantor (the “Seller”) – The party who owns the property but is in the process of selling. In most cases, only the grantor signs the deed.

Grantee (the “Buyer”) – The purchasing party who shall have their information entered on the deed as such. The grantee (or their legal or real estate agents) is to receive the deed after it has been processed in a local registry.

Legal Description – Obtained either at the local or county level. It is good practice to go online and find the property or contact the local assessor or recorder. The description often incorporates these identifiers:

- Tax Map/Lot Numbers

- Deed Book & Page Numbers

- Parcel Identification Number (if any)

Mailing addresses are usually not included in the Legal Description.

Notary Public – A state-authorized individual who will acknowledge the signature of the Grantor. Most states require this attestation.

Preparer – The individual who is writing the document.

Receiver (After Recording, Return to) – As mentioned above, the grantee should be listed here unless the situation dictates otherwise.

Witness(es) – In some states, witnesses can be used in lieu of notarization, or state law may require witnesses alongside a Notary Public.

Where to Record?

After the form has been downloaded, completed, and signed, it is ready to be recorded at the Registry of Deeds (or other County/Town office). The deed may be filed at the respective office below:

How To Write

Download; PDF (.PDF), Microsoft Word (.Docx), Open Document Text (.ODT)

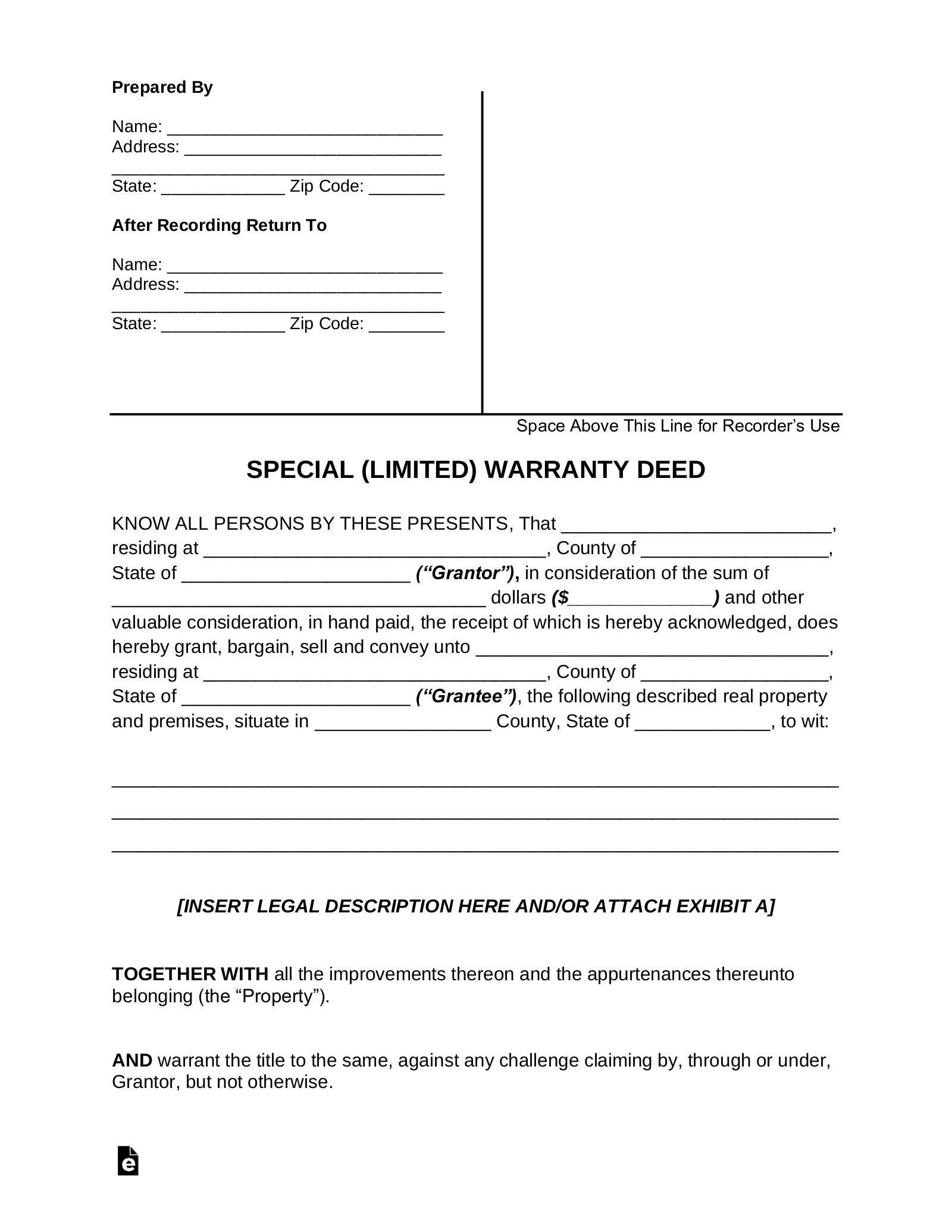

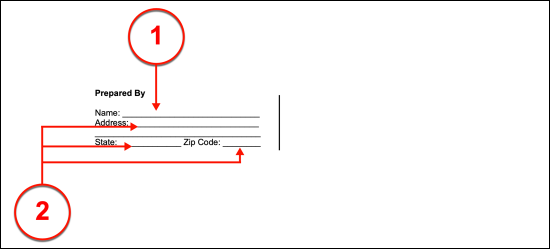

I. Prepared By

(1) Name Of Preparer. This paperwork may be furnished with the information it requests by a specific Preparer. He or she may not necessarily be directly involved with the topic of this paperwork and may be acting only in an administrative or clerical role but must be identified nonetheless. Therefore, make sure that the name of the Party who has supplied the information to this deed is presented where requested.

(2) Address Of Preparer. The mailing address where the Preparer can be contacted for further information regarding his or her role in this paperwork should be displayed with his or her name.

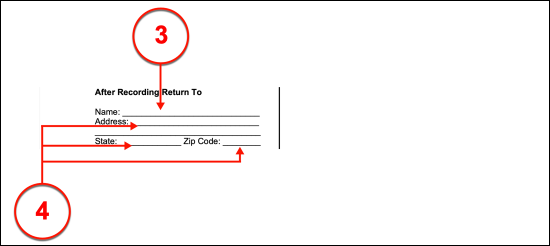

II. After Recording Return To

(3) Intended Recipient Name. The Party who must receive the signed original of this paperwork should be established in the header as well. Generally speaking, this will be the Grantee however it may be any Party that the signature Parties wish this document returned to once it has been registered with the appropriate County and/or State.

(4) Recipient Address. Naturally, in order for the concerned County’s Clerical Staff to send the Recipient the filed paperwork, the address of the Recipient will be necessary. Provide the formal mailing address for the final Recipient of the filed deed.

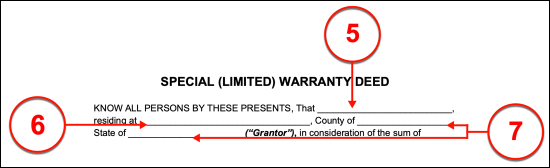

III. Statement Of Special (Limited) Warranty Deed

(5) Deed Grantor Name. The Party who intends this paperwork to function as a release to his or her claim or ownership of real property must be named as the Grantor of this deed. His or her full name must be presented to the statement this document makes.

(6) Address Of Special Warranty Deed Grantor. The formal home address where the Grantor maintains his or her residence should be supplied to continue the Grantor’s statement of release. This information must be composed of the building number and street name where the Grantor lives. If a unit number is needed to physically visit the Grantor at this address make sure this information is included as well.

(7) County And State Of Deed Grantor. Furnish the County where the Grantor’s residence is located as well as the State to complete the process of identifying the Grantor.

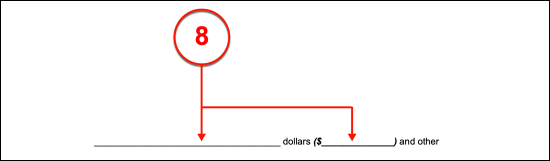

(8) Sum Of Consideration. The dollar payment the Grantor expects by the signing of this paperwork in exchange for his or her release of the concerned property through this deed should be documented in writing then displayed numerically.

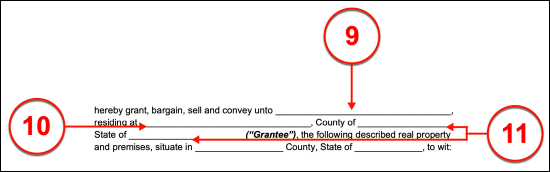

(9) Grantee Receiving Special Warranty Deed. The statement made will concern a second Party. The full name of the Receiver of this deed or the Grantee must therefore be documented where requested. This must be the Grantee’s legal name.

(10) Grantee Address. The building number, street, and apartment or unit number of the Grantee is required by this statement.

(11) Grantee County And State. The residential County and State where the Grantee’s home is found must be documented.

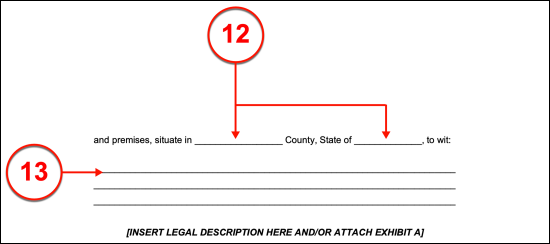

(12) County And State Of Released Property.

(13) Property Released By Special Warranty Deed. The real property the Grantor will release as a result of the payment consideration defined above and this paperwork must be clearly identified. To this end, the legal description of the property should be transcribed from the County’s records to this document. Since this deed is meant to be used in nearly every state, some counties and states will require that additional information be supplied such as the tax parcel number of the property. It is recommended that an appropriate professional is consulted to make sure this area is completed in compliance with the local statutes where the concerned property is located.

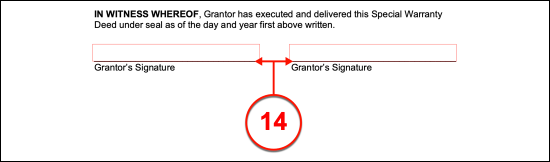

(14) Signature Of Grantor Effecting Release. The Grantor identified at the beginning of this deed’s statement must sign his or her name upon the completion of the above sections. It will be assumed that the requirements for the conveyance of this property has been satisfied therefore, the Grantor should only sign his or her name when he or she is prepared to release the concerned property. Notice there is enough room for two Grantors to sign their names. If more are required to release the property through this document, then each must provide his or her signature on an attachment, directly to additional signature areas inserted by the Preparer, or compose a separate deed. It is important to mention that such an attachment should be signed by any Witnesses required by the State where this deed is issued since each additional Grantor must satisfy the same requirements of that jurisdiction.

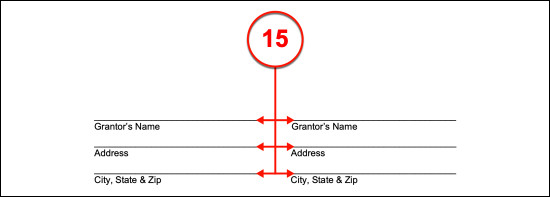

(15) Signature Grantor Information. The printed name of the Grantor along with his or her address should be supplied when he or she signs this paperwork. This requirement must be met by every Signature Grantor.

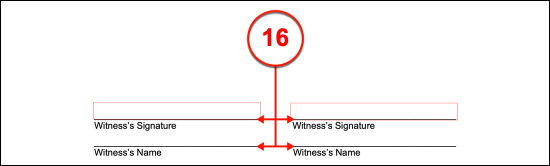

(16) Witness’s Signature Verification. Oftentimes, it will be mandatory or at least strongly recommended that the Grantor’s act of signing is witnessed as well as notarized. To this end, a Witness to the Grantor’s signature must sign his or her name then print it to the area provided once he or she has watched the Grantor complete the signature process.

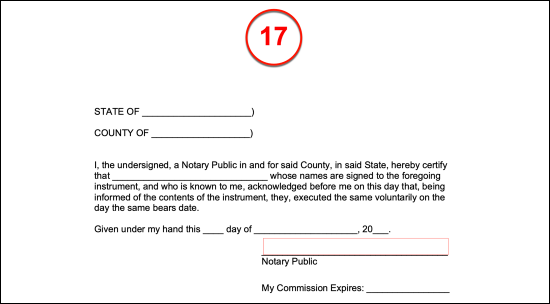

(17) Notarization Of Grantor Signing. The Notary Public serving the Grantor’s act of signing will verify the Grantor’s identity and the date when he or she signed this deed in the final section of this issuance. Only a licensed Notary Public is permitted to legally conduct the notarization process during the Grantor’s act of signing.