Updated March 17, 2024

A quit claim deed, or “quitclaim,” transfers the ownership and rights of a property with no guarantees from a grantor (“seller”) to a grantee (“buyer”). A quitclaim conveys all ownership interests of the grantor only. If there are other owners of the property, their percentage share will remain the same.

Signing Requirements

A quit claim deed must be signed with witnesses present or notarized in accordance with State law.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

When to Use a Quit Claim Deed

Because of the uncertainty that comes with quitclaim deeds, it is common to think that these documents are unreliable and aren’t worth the risk. You would be surprised then to learn that there are a lot of practical and convenient uses for a quitclaim deed. Quitclaim deeds are used for:

1. Transfer real property between family members

Since this deed offers the least amount of buyer protection, it is often used for transferring properties between people who trust each other—such as family members. The grantor and the grantee then would either have knowledge about or be able to trust the claim to the title of the property.

Typical arrangements between family members include parents passing on their house to their adult children or siblings trading real property with each other. Often, using the quitclaim deed in these scenarios means that there is no sale on the property or money trading hands.

2. Correct a defect on the title

Quitclaim deeds are also an efficient means of correcting a mistake on the title without extra costs and time in legal litigations. Mistakes can be as simple as a spelling error in the name of the titleholder to something as complex as ambiguity around who the real titleholder is. The quitclaim deed can resolve all of these by using the correct and intended information for the title that then is notarized by a county or city official. Once such defects or inaccuracies are clarified using the quitclaim deed, a warranty deed or special warranty deed may be used to resolve any finer details about covenants in the transfer of property.

3. Add or remove a spouse or another individual from the title

Along with making corrections to the title, quit claim deeds can also add or remove a spouse from the title of the deed. Quitclaim deeds make it quick and easy to arrange properties after marriages or divorces. The process is very much similar to when one fixes a mistake in the title.

4. Avoid the probate process through transfer into a living trust

Quitclaim deeds are also an excellent means to transfer real property into a living trust. It cuts through the litigation process and can save time and money at the time of death.

The deed will already have given the title to the appropriate beneficiary making the probate process short or completely unnecessary. As long as the title and claim of the property are legitimate, there would be few means of contesting the transfer of the real estate in this way.

How to File a Quit Claim Deed (4 Steps)

Filing a quitclaim deed will convey ownership to the grantee. In order to properly submit this request, there must be consideration provided (purchase price) and a sufficient description of the premises. The form must be properly signed in accordance with state requirements. The form must then be filed with the local recorder’s office, completing the process.

Step 1 – Negotiate with the Owner

Like any ownership interest, there must be a price that is agreed upon by the parties. Most commonly, a quitclaim is used when purchasing a portion of real estate interest. Therefore, there is usually no need for a real estate agent or other negotiating individual.

An attorney is always recommended to ensure the parties succeed in legally filing the transaction.

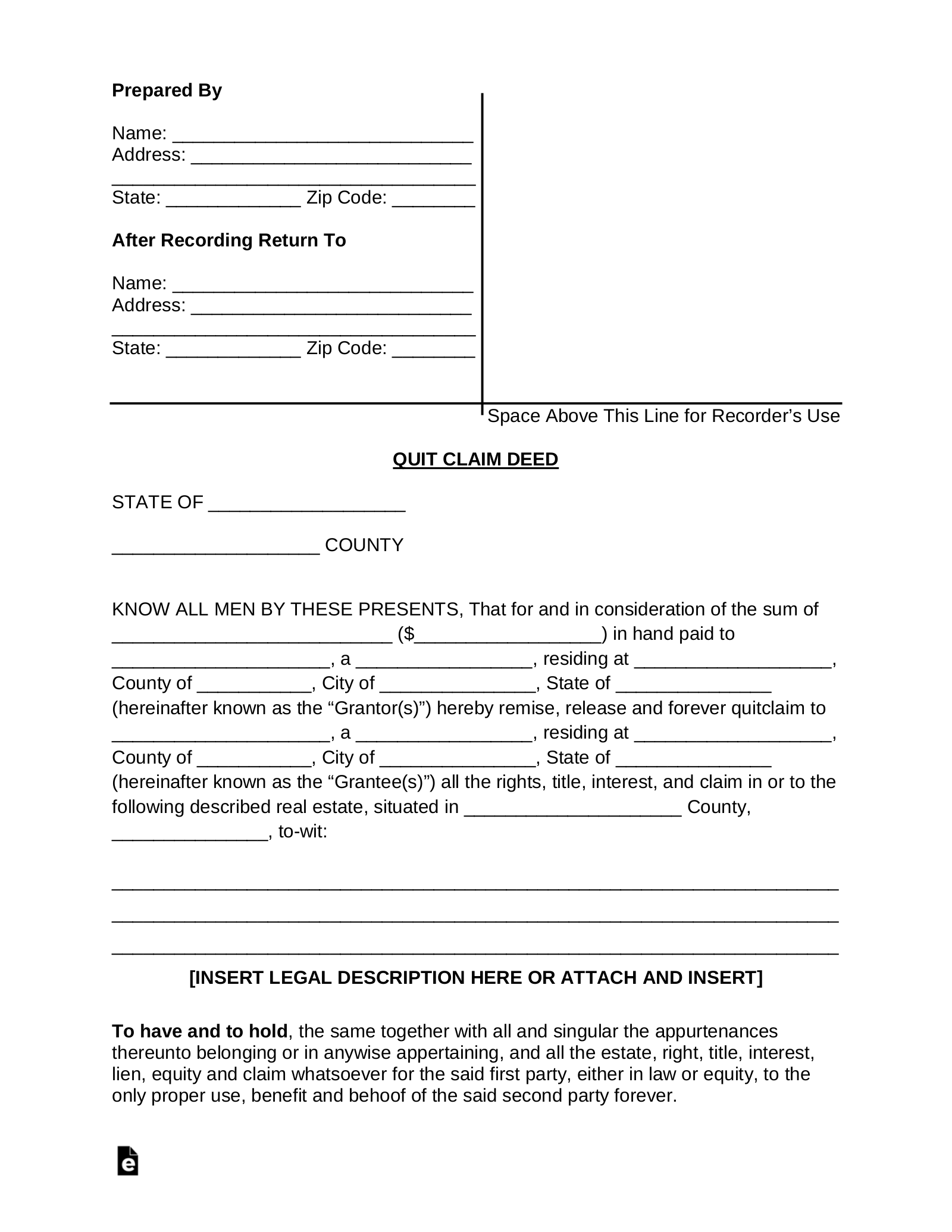

Step 2 – Gather the Required Information

In order for most county and city recorders to process the deed, the following information is required:

- Preparer’s By – Individual that writes the form.

- Where to Mail After Recording – Where to send the deed after it is filed. This is usually the grantee or their attorney.

- Grantee’s Information – Buyer’s full name and mailing address.

- Grantor’s Information – Seller’s full name and mailing address.

- Consideration – Purchase price ($).

Legal Description – Obtain the “Deed Book and Page Numbers,” which can be found at the county or city recorder’s office. It is also recommended, although not required, to list the “Tax Map & Lot or Parcel ID” provided by the county or city assessor’s office included in the description.

Step 3 – Authorizing the Form

The form will need to be executed in accordance with the state signing requirements. This usually consists of either two witnesses and/or a notary public. Both grantor and grantee will be required to appear in front of the witnessing party.

Step 4 – Filing/Recording the Deed

The deed will now need to be recorded. Every jurisdiction in the United States has a recording office that can be found here depending on the state.

Quitclaim Deed vs. Warranty Deed

Quitclaim deeds do not offer much buyer protection when it comes to the transfer or sale of real estate. They are simple and require a minimal amount of information to justify them as a legal document. This is what makes them so different from warranty deeds.

Warranty deeds are far more common in the sale of real estate because they provide what quitclaim deeds do not. It addresses many of the finer points and takes more time to write up. Some of the additional information includes:

- Warranty of the title and that the grantor has the authority to sell/trade the property

- Legal insurance and responsibility if a third party challenges for the title to the property

- Guarantee that there are no debts attached to the property or other unexpected burdens

- Full description of the property, including its exact legal boundaries

Warranty deeds offer the most buyer protection and take a lot more time to set up.

Definitions

Consideration – The purchase price.

Grantor – The selling party, typically the owner of the property. Only the grantor is required to sign the quit claim.

Grantee – The buying party to whom the quit claim will be returned after it has been processed.

Legal description – This usually has to be obtained either on the local or county level. It is best to go online and find the property or contact your local assessor or recorder. It is best to include the following in your description:

- Tax map/lot numbers

- Deed book & page numbers

- Parcel identification number (if any)

*Mailing addresses are usually not included in the legal description.

Notary Public – Required to acknowledge the signature of the grantor in most states.

Preparer – The individual that is writing the document.

Receiver – The grantee should be listed here with a mailing address for all real estate taxes and notices.

Witness(es) – In some states, witnesses are required either as an option to having the form notarized or as a requirement alongside a notary public.

Where to Record a Quitclaim Deed

After the form has been downloaded, completed, and signed it is ready to be recorded at the Registry of Deeds (or another county/town office). The form may be filed at the respective office below: